Cash Flow is Important

I learned about cash flow due to running into cash flow issues! I have spent time at different stages in my career working in my family’s franchise business, working for franchisors and supporting franchisees. The goal has always been to drive top-line revenue and bottom-line results. To do this, I learned firsthand the importance of delivering first-in-class customer service, having a product/service the customer wanted to come back for, and how to measure my success.

For this series of posts, I will focus on understanding the financial reports available when running your business. As many new business owners will discover, time is in short supply, and you tend to play whack-a-mole; when you have the time, you focus on the things you can do and do well.

Firsthand, anything to do with accounting is typically last on the list for myself and most business owners. I know what’s in the bank, what’s coming in, and what’s going out. I’m good, right? Not necessarily.

A cash flow statement is one of the most straightforward tools you can develop independently. The cash flow goal is to measure outflows (what you’re paying out) and your inflows (what’s coming in). The delicate balance of running a business when you start is managing your cash flow and the timing of when payments are going out and coming in.

Cash Flow Example

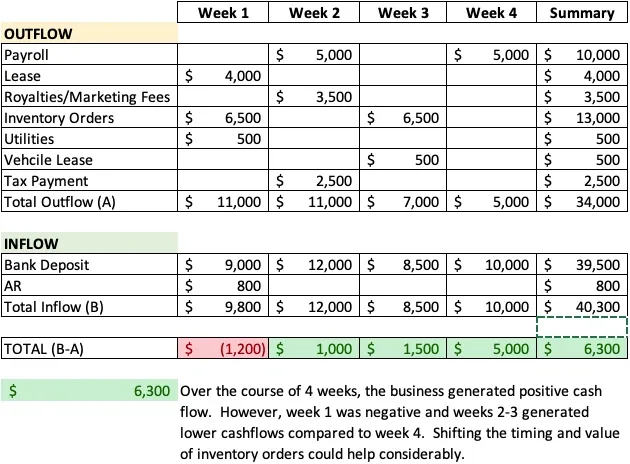

Here’s an example for you, over a four-week month, you will more than likely have the following expenses:

- Payroll – Week 2, Week 4

- Lease Payment – Week 1

- Franchise Royalties/Marketing Fees – Week 2

- Inventory Orders – Week 1, Week 3

- Weekly Bank Deposit – Week 1,2,3,4

- Utilities – Week 1

- Vehicle Lease – Week 3

- Tax payment – Week 2

You could pay these outflows as they come in, OR you could be strategic and pay them when you know you’ll have more cash on hand or, more importantly, leverage payment terms to help with the payments. You can’t change the timing of your fixed payments, like leases, payroll, franchise fees, and taxes. Still, you can change the timing of your inventory order to possibly once a month during week 3, for example. If they exist, you could also use payment terms to push the payment out from this month to the next. With your inflow of bank deposits – increasing the frequency of deposits from weekly to Monday/Thursday will give you a more consistent balance in your account.

Payment Terms

The other key to tracking your outflow and inflow is to see when you could run into a cash crunch and work with vendors for payment terms. Receiving inventory on a Friday with a three business day payment term would give you an extra two days to generate cashflow (Saturday/Sunday) vs receiving on a Monday and having to pay on Thursday.

This is a valuable way to measure the performance of your business that does not require an accounting background. You need to take the time to look at a prior month to understand what is being paid out and when. To make things easier, I have created a simple cash flow in Excel that you can use to get started if you have any questions on how to use this tool, email or leave a comment.

Keep grinding and know that the more you see how the money flows, the better you’ll understand if your business generates positive or negative cash flow.