What to look for on Income Statement as it relates to your business.

There are some key percentages that you can look at on your income statement that, over time will be a barometer of how you measure your franchise business performance. The first one is the Cost of Goods Sold. These are the direct costs associated with the sale of a product or service. For example:

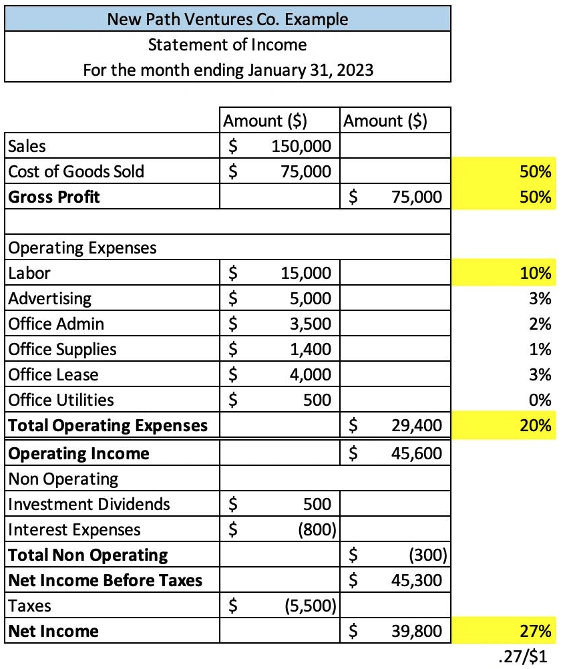

Example Income Statement Percentages

Cost of Widget ($5) | Sale of Widget to Customer ($10)

In this example, for the sale of every widget, your cost of goods sold is $5. Since your selling price is $10, your cost of goods sold as a percentage of revenue is 50% ($5 / $10). Let’s say the following month, your cost remains at $5, but your selling price goes up to $11; your cost of goods sold as a percentage of revenue is 45% ($5/$11).

The lower your cost of goods sold as a % means, the more money you will have to cover the expenses in your business and potentially have more profit.

Labour Expense as a Percentage

Another factor to look for as you analyze your income statement is that you want to know what % of revenue does your labour expense represent. Using the same logic above, you divide the labour expense by the revenue to arrive at a %. Month over month, you will be able to see if your labour as a % remains constant or if it has peaks and valleys. Keep in mind, if labour is a % of revenue, then on months where your revenue is high, you’ll see a lower labour %, and on months where your labour is high as a % you will have lower revenue. Again, looking at this data point simply gives you insight into trends, and you’ll have to dig a little deeper as to why your revenue might be low/high or your labour spend is low/high.

Net Income as a Percentage

The last factor I would look at is your Net Income as a % of revenue. Ultimately this will give you insight into how profitable your business is. In this example, the business provides a 27% return during this period, which means for every dollar of revenue, the business keeps .27. Depending on the industry you’re in, this might be high or low, but the goal is just to understand from one income statement period to another what the variability is and what might cause this % to go up or down.

The goal of reviewing the income statement is so you can get a better grasp of the trends in revenue and expenses. With this insight, you can make better decisions as to when to ramp up staffing or when you may have slow periods in the business for example. Knowledge is power when it comes to making decisions in your business versus managing your business from the balance in your bank account. This post is not extensive, and you should review the relevant percentages of your franchise business with your accountant. If you are part of a franchise system that shares income statement results, then you’ll be able to compare your performance against other locations.

Feel free to leave a comment or to reach out by an email with how you use your income statement in your franchise business to make decisions.

Other helpful links in the Measuring Franchise Performance Series: