An income statement is one of the most critical financial statements businesses, investors, and analysts use to understand a company’s financial performance. Also known as a profit and loss (P&L) statement, an income statement summarizes a company’s revenues, costs, expenses, gains, and losses over a specific period, typically monthly, quarterly or annually. I’ll share the benefits of an this statement and why franchise businesses need to prepare and analyze this statement regularly.

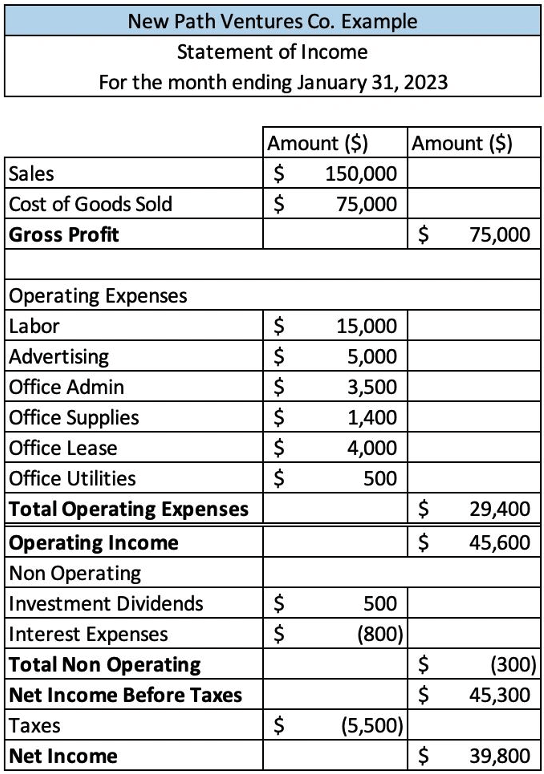

Example Income Statement

Helps Evaluate Financial Performance

The primary benefit of an income statement is that it provides a comprehensive summary of a company’s financial performance during a specific period. It helps franchise business owners evaluate how much revenue their business has generated and how much expenses it has incurred. With this information, you can determine whether the business has generated a profit or incurred a loss during the period. Understanding how you generated the profit will allow you to better plan in the future and hopefully replicate the results again.

Identifies Revenue and Expense Trends

By analyzing an income statement, franchise owners can identify revenue and expense trends. For instance, they can determine whether their revenue has increased or decreased over time and if there are any changes in their revenue streams. Similarly, they can also analyze their expenses and identify any cost-saving opportunities or potential areas where they need to invest more resources. Once you start reviewing your income statement, you will better know the seasonality or peaks/valleys in your business.

Helps Make Informed Business Decisions

An income statement provides franchise businesses with critical information that they can use to make informed business decisions. For instance, if a business needs to generate more revenue, it may need to reconsider its pricing strategy or focus on increasing its sales efforts. Similarly, suppose a business is incurring high expenses. In that case, it may need to identify areas where it can cut variable costs to improve profitability.

Assists in Budgeting and Forecasting

An income statement is also an essential tool for budgeting and forecasting. By analyzing historical income statements, franchise businesses can make informed decisions about their future revenue and expenses. You can use this information to create realistic budgets and forecast future financial performance accurately.

Suppose you’re working within a franchise system. In that case, you can also compare your results against other locations to determine where you can improve your franchise. An income statement is an essential financial statement that provides critical information about a company’s financial performance.

By analyzing this statement regularly, franchise businesses can evaluate number of factors related to financial health. Identify revenue and expense trends, make informed business decisions, and facilitate budgeting, forecasting, and financial planning and analysis. Get into the habit of looking at this crucial financial tool monthly. Start comparing your revenue and expenses to determine where the opportunities are. If you’re not confident in what to look for, bring this up with your accountant, who will have insight into what to look for.

Other helpful links in the Measuring Franchise Performance series:

- Measuring Franchise Performance – Cash Flow (Part I)

- Measuring Franchise Performance – Cash Flow (Part II)

- Measuring Franchise Performance – Income Statement (Part II)

- Measuring Franchise Performance – Balance Sheet (Part I)

- Measuring Franchise Performance – Balance Sheet (Part II)

- Measuring Franchise Performance – Balance Sheet (Part III)

- Measuring Franchise Performance – Balance Sheet (Part IV)