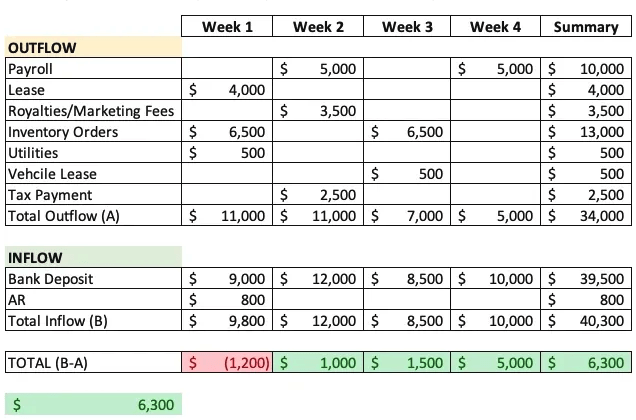

In Part 1, I discussed the value of measuring outflow and inflow related to the cash flow in your business. For clarification, when I use the term cash, I am referring to all payment methods (cash, credit card, wires, check…). We left off in the last post with you having a better sense of whether your cash flow is positive or negative. What now? You are looking at your cash flow in any given week or month. You want to ensure you will be in a favourable position – meaning you have more inflows than outflows. In this example, green represents positive (more revenue than expenses), and red represents negative (more expenses than revenue):

Positive

When you have a positive cash flow, it means you’re bringing in more revenue than expenses, which is a fantastic spot to be in! In times when you’ve got good cash flow, it’s essential to understand how this happened. Some things to ask yourself:

1) Does this result from a spike in promotional activity and customer behaviour?

2) Is this a result of delaying an expense payment that will come around next month?

3) Can these results be duplicated moving forward?

Often, having a positive cash flow over the course of a month may not be a reflection of a new norm in the business. Still, it could result from an expense being delayed to the following month or a successful promotion. Either way, your goal is to determine if these results can be replicated, and if so, you’re definitely in a good spot.

Negative

However, if you finish a week or month with negative cash flow, this is definitely a concern that needs to be addressed:

1) Why are expenses high for this period?

2) What costs can be cut or payments spread out to reduce the likelihood of future negative cash flows?

3) How can inflows (revenue) be increased?

Whenever negative cash flows happen, it’s imperative to understand why they happen. I recall that in a company I worked as Regional Manager, a petroleum location saw cash drop drastically over 8 weeks. This was due to significant road construction that deterred regulars from purchasing. The good news was this was not a long-term situation. However, it would take better management of outflows during this time. Further to this, having a negative cash flow could be the result of consistently low revenues. In the franchise world, you can talk to other franchisees who are succeeding and what they’re doing to drive revenues. Could it be a team member not up-selling or providing exceptional service? Again, paying attention to the cash flow will help you understand the inflows and outflows of your business and how to mitigate issues before they become a big problem.

Next Steps

If you’re looking for assistance with understanding your cash flow, feel free to leave a comment or send us an email. We’re happy to help. Reviewing your annual cash flow with your accountant once your financial statements are prepared is also a good idea.

Other helpful links in the Measuring Franchise Performance series:

Measuring Franchise Performance – Cash Flow (Part I)

Measuring Franchise Performance – Income Statement (Part I)

Measuring Franchise Performance – Income Statement (Part II)

Measuring Franchise Performance – Balance Sheet (Part I)

Measuring Franchise Performance – Balance Sheet (Part II)

Measuring Franchise Performance – Balance Sheet (Part III)

Measuring Franchise Performance – Balance Sheet (Part IV)