May 9, 2024

Planet Fitness recently released its financial results for the first quarter of 2024, showcasing a mix of growth and challenges. Here’s a comprehensive overview of their performance, broken down into key areas:

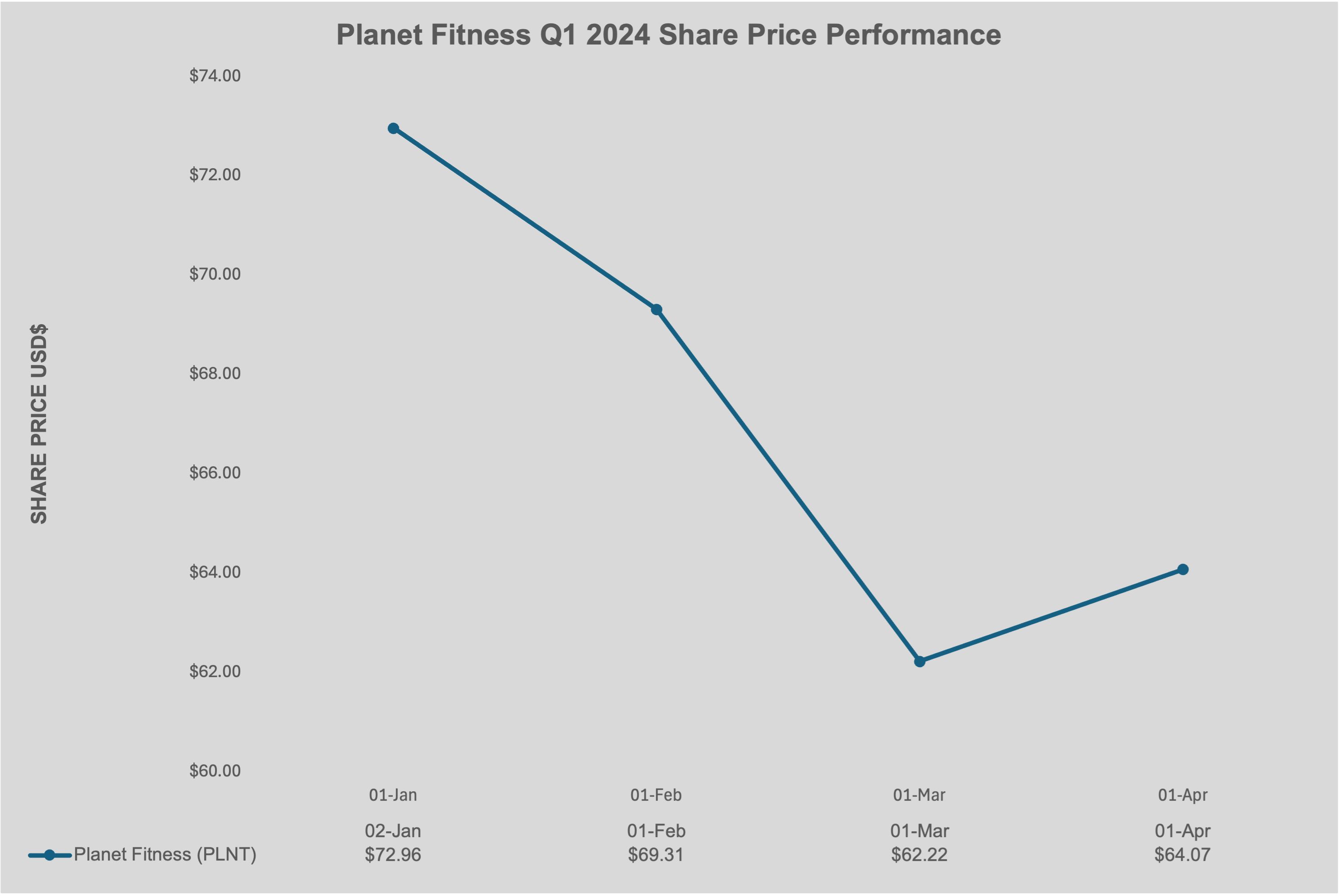

Share Price Performance

Planet Fitness Q1 Performance

Membership and Sales Growth

Membership: Planet Fitness ended the first quarter with approximately 19.6 million members. This growth was primarily driven by new member sign-ups, despite facing some challenges in consumer engagement early in the year[4][5].

Same Store Sales: The company reported a 6.2% increase in same-store sales, indicating improved performance at existing locations compared to the previous year[5].

Financial Performance

Revenue: Total revenue for the quarter rose by 11.6% to $248.0 million, up from $222.2 million in the same period last year. This increase was driven by growth in both franchise and corporate-owned segments.

Net Income: Net income attributable to Planet Fitness was $34.3 million, or $0.39 per diluted share, compared to $22.7 million, or $0.27 per diluted share, in the prior year period. Adjusted net income increased by 29.9% to $47.3 million, reflecting a strong operational performance.

Adjusted EBITDA: This metric, which measures profitability, increased by 17.8% to $106.3 million, highlighting the company’s ability to manage costs and improve efficiency.

Store Expansion

New Openings: During the quarter, Planet Fitness opened 25 new stores, bringing the total number of locations to 2,599. These included 23 franchisee-owned and 2 corporate-owned stores, indicating continued expansion efforts[5].

Strategic Initiatives and Challenges

Franchise Growth Model: The company is advancing its New Franchisee Growth Model to support franchisees and enhance shareholder value. This includes reducing capital requirements for opening and operating a franchise location[6].

CEO Transition: Planet Fitness announced that Colleen Keating will join as the new CEO in June, bringing extensive experience in operations and brand management. This leadership change is expected to support the company’s next phase of growth[5][6].

Pricing Strategy: The company plans to increase the price of its Classic Card membership from $10 to $15 for new members, aiming to enhance average unit volumes without significantly impacting membership growth[6].

Outlook for 2024

Revised Expectations: Planet Fitness has adjusted its outlook for 2024 due to several headwinds, including a shift in consumer focus and a national advertising campaign that did not perform as expected. The company now expects revenue to increase by 4% to 6%, adjusted EBITDA to grow by 7% to 9%, and adjusted net income per share to rise by 7% to 9%.

Conclusion

Despite facing challenges such as a hesitant consumer base and less effective advertising, Planet Fitness has shown resilience through strategic initiatives and leadership changes. The company is optimistic about its future growth, supported by its expanding membership base and store network. The upcoming price adjustments and new leadership are expected to further drive Planet Fitness’s growth in the competitive fitness industry.

Information Source: https://investor.planetfitness.com/investors/press-releases/default.aspx