The Planet Fitness Q3 2024 results showcase its financial and operational strength. With steady revenue and membership growth, targeted strategic investments, and an enhanced member experience, the fitness franchise giant is signaling confidence in its long-term vision. The quarter saw the company not only improve its financial outlook but also launch a significant share repurchase initiative and raise membership pricing for the first time in over 25 years — a bold move underscoring its market value.

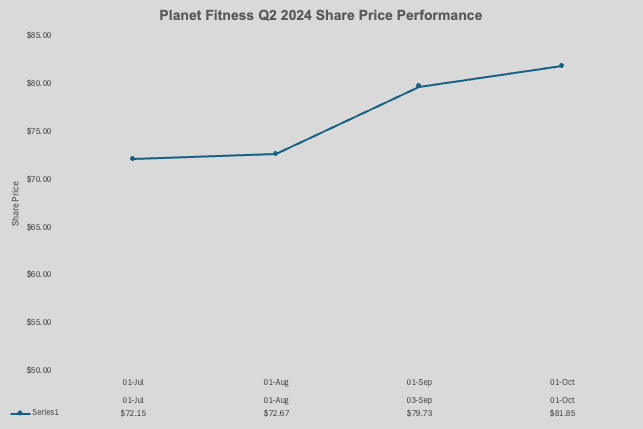

Planet Fitness Share Price Performance Q3 2024

Key Financial Highlights

-

Revenue Growth: Q3 revenue rose 5.3% year-over-year to $292.2 million.

-

Net Income: Net income attributable to Planet Fitness increased to $42.0 million, or $0.50 per diluted share, up from $39.1 million in Q3 2023.

-

Adjusted EBITDA: Up 10% from last year, reaching $123.1 million.

-

Adjusted Net Income: $54.7 million or $0.64 per diluted share, reflecting a 5.7% increase year-over-year.

-

Cash Position: The company ended the quarter with $530.7 million in cash and marketable securities.

-

Club Expansion: 21 new clubs opened, bringing the total to 2,637 locations globally.

Strategic Initiatives and Market Performance

Planet Fitness continued executing against its strategic goals:

-

Membership Pricing: The Classic Card membership price increased to $15 for new members — the first increase in over 25 years — reflecting confidence in its customer value proposition.

-

Club Growth: Continued expansion with a mix of franchisee- and corporate-owned locations, demonstrating ongoing demand and development activity.

-

Share Repurchase Program: The company completed a $280 million share buyback and launched a new $500 million share repurchase plan, signaling strong shareholder confidence.

-

Segment Performance:

-

Franchise Segment Revenue: Grew 4.3% to $102.4 million, with same club sales up 4.5%.

-

Corporate-Owned Clubs: Posted a 13.1% revenue increase, driven by a 3.4% rise in same club sales and new club openings.

-

Equipment Sales: Declined 6.7% to $61.7 million, attributed to fewer equipment placements compared to Q3 2023.

-

Challenges and Outlook

Despite a strong quarter, Planet Fitness faces some headwinds:

-

Equipment Sales Softness: A drop in equipment revenue highlights variability in franchise development pace.

-

Interest Expense: Net interest expense remains high at approximately $75 million annually.

-

Capital Expenditures: Revised to increase 20% in 2024 due to higher investment in corporate-owned clubs.

Outlook:

-

Full-year revenue is now projected to grow 8–9%, up from prior estimates of 4–6%.

-

Adjusted EBITDA and adjusted net income are also expected to rise 8–9% year-over-year.

-

Adjusted EPS is forecasted to increase 11–12%, highlighting operational leverage and share repurchase impact.

Conclusion

With strong financial results, strategic clarity, and an expanding global footprint, Planet Fitness continues to be a leader in the fitness franchise sector. Its ability to raise prices, invest in growth, and reward shareholders speaks to the strength of its brand and business model. As it enters the final quarter of 2024, the company is well-positioned to maintain its growth momentum and deliver long-term value to members and investors alike.