In this post, we break down the key highlights from Planet Fitness’ Q2 2024 financial results, examine its strategic priorities, and explore the challenges and outlook shaping its path forward.

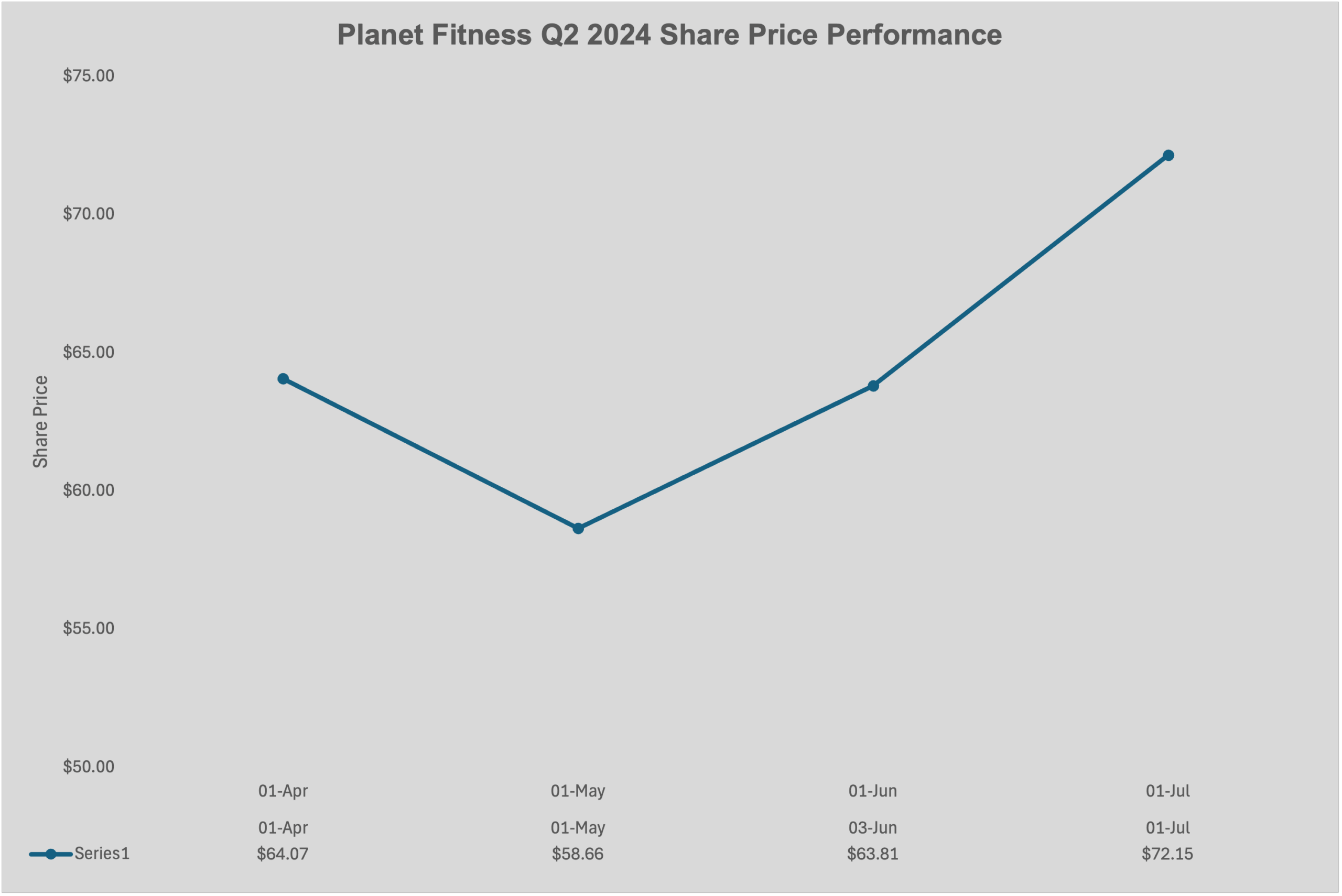

Share Price Performance

Key Financial Highlights

Planet Fitness reported a strong second quarter for fiscal 2024, showcasing its resilience and ongoing growth. Total revenue rose 5.1% year-over-year to $300.9 million, driven by a 4.2% increase in system-wide same-store sales. Net income attributable to Planet Fitness, Inc. reached $48.6 million ($0.56 per diluted share), up from $41.1 million ($0.48 per diluted share) in the same period last year. Adjusted net income, which excludes certain non-cash items, increased 7.8% to $62.2 million ($0.71 per diluted share).

The company’s Adjusted EBITDA grew by 7.2%, reaching $127.5 million, supported by strong performance across both franchise and corporate-owned store segments. Notably, 18 new stores opened during the quarter, bringing the total store count to 2,617 worldwide and expanding Planet Fitness’ membership base to approximately 19.7 million members.

In terms of cash, the company reported $447.7 million in cash and marketable securities as of June 30, 2024, providing a solid financial cushion for future investments and growth.

Strategic Initiatives and Market Performance

Under the leadership of new CEO Colleen Keating, who joined in June, Planet Fitness is sharpening its growth strategy. The company successfully refinanced $800 million of debt and executed a $280 million accelerated share repurchase program, signaling confidence in its long-term shareholder value.

Strategically, Planet Fitness remains focused on expanding both domestically and internationally. The asset-light, franchise-driven model allows it to scale efficiently while maintaining strong unit economics. During the quarter, franchise segment revenue increased by 9.1%—fueled by both same-store sales growth and the opening of new locations—while corporate-owned store revenue grew by 10.3%.

The company also launched initiatives to evolve its brand messaging and enhance the member experience, operating under the philosophy that “when franchisees win, Planet Fitness wins.” This alignment between corporate and franchise performance underpins its ambitions for sustainable growth in store count and membership.

Challenges and Outlook

Despite its successes, Planet Fitness faces several headwinds. Equipment segment revenue declined by 8.4% compared to the prior year, reflecting fewer equipment sales to both new and existing franchisee-owned stores. Rising capital expenditures—expected to increase by approximately 25% in 2024—will also put pressure on margins, largely due to planned additions to the corporate-owned store portfolio. Additionally, net interest expenses are expected to remain elevated at around $75 million for the year, following the recent refinancing activity.

Looking ahead, Planet Fitness is reiterating its 2024 guidance:

-

New franchise equipment placements: ~120 to 130 locations

-

System-wide new store openings: ~140 to 150 locations

-

System-wide same-store sales growth: 3% to 5%

-

Revenue growth: 4% to 6%

-

Adjusted EBITDA growth: 7% to 9%

-

Adjusted net income growth: 4% to 6%

While the fitness industry remains competitive, Planet Fitness’ large membership base, scalable franchise model, and strategic initiatives position it well to capture further market share. Continued focus on brand evolution, member experience, and international expansion will be critical to achieving its ambitious long-term goals.