Continuing in the Measuring Franchise Business Performance series, in this post, I will continue the discussion on the balance sheet and what I would look for.

We know the balance sheet shows what the company owns (assets), what it owes (liabilities), and the difference between the two (equity). Reading a balance sheet can be intimidating for those unfamiliar with accounting terminology. Still, with some basic knowledge, anyone can understand it.

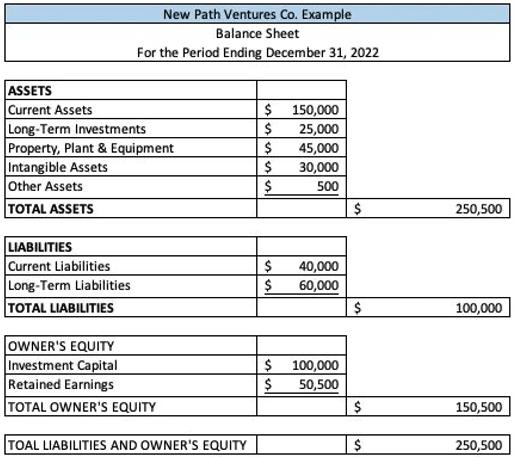

New Path Ventures Co. Balance Sheet Example

Here are the steps to read a balance sheet:

Step 1: Review the Assets Section

The assets section of the balance sheet shows what the company owns. This includes current assets (such as cash, accounts receivable, and inventory) and long-term assets (such as property, plant, and equipment). Look for the total assets line, which will show the company’s total value of assets. Current assets can be converted into cash or collected within the next 12 months. Long-term assets, as implied, will take longer than 12 months to liquidate and collect.

Step 2: Review the Liabilities Section

The liabilities section of the balance sheet shows what the company owes. This includes current liabilities (such as accounts payable, short-term loans, and taxes) and long-term liabilities (such as bonds and mortgages). Look for the total liabilities line, which will show the company’s total value of liabilities.

When considering liabilities, it’s helpful to distinguish between those that are due in the next 12 months and those that are owed over a longer period of time, just like in the assets section.

Step 3: Calculate the Equity Section

The equity section of the balance sheet shows the company’s ownership, including common stock and retained earnings. Retained earnings are important because they represent the amount of money that remains in the company after taxes have been paid and is carried over to future periods. To calculate the equity section, subtract the total liabilities from the total assets. The resulting number is the company’s equity.

Step 4: Analyze the Numbers

Once you have reviewed the three sections of the balance sheet, you can analyze the numbers to understand the company’s financial position. A company is deemed financially healthy when it has more assets than liabilities. However, if the company has more liabilities than assets, it may face financial difficulties. Look for trends in the numbers over time, such as an increase in assets or a decrease in liabilities, which could indicate positive changes in the company’s financial position.

Step 5: Look for Additional Information

In addition to the basic information on the balance sheet, there may be additional information in the footnotes or accompanying documents. For example, the footnotes may provide more detail on the company’s accounting policies or significant events affecting the financial statements. Reviewing this additional information to get a complete picture of the company’s financial position is essential.

Reading a balance sheet can seem daunting. Anyone can understand it with a basic understanding of accounting terminology and a systematic approach to reviewing the information. By analyzing the numbers and looking for trends over time, you can gain valuable insights into a company’s financial position and make more informed investment decisions. If you’re not doing it already, review this financial report with your accountant to gain their perspective on how similar businesses compare.

Here are some helpful links in the Managing Franchise Performance Series: