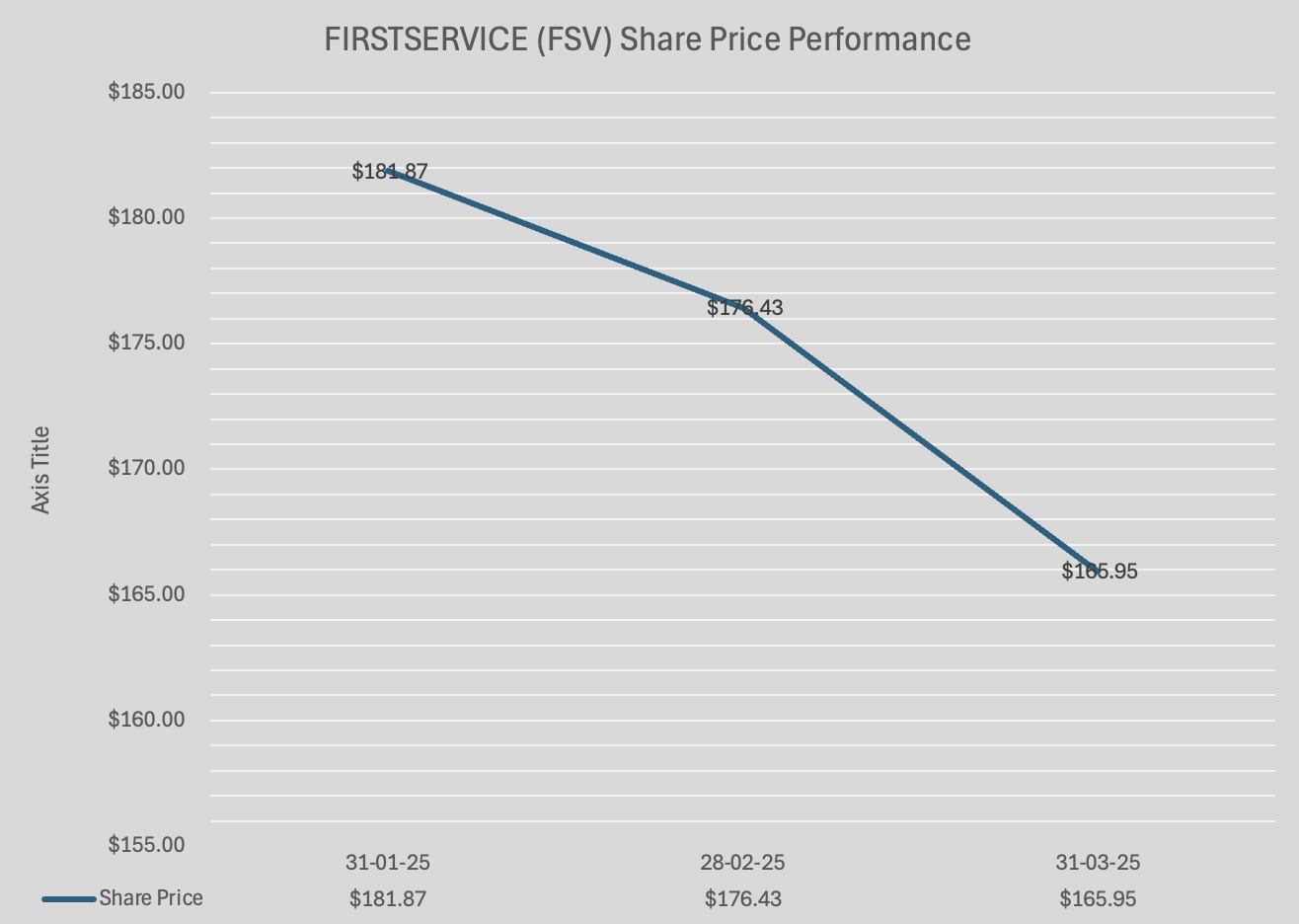

FirstService’s Q1 2025 results show solid momentum, with strong top-line growth and expanding profit margins in both core divisions. Despite macroeconomic uncertainty, the company demonstrated disciplined execution and continued to invest in long-term value creation. CEO Scott Patterson praised the operational teams for delivering profitable growth while staying on track to meet the company’s annual targets.

Key Financial Highlights

FirstService delivered notable improvements across its key financial metrics in Q1 2025:

-

Total revenue grew 8% year-over-year to $1.25 billion.

-

Adjusted EBITDA rose 24% to $103.3 million.

-

Adjusted EPS increased 37%, reaching $0.92 versus $0.67 in Q1 2024.

-

GAAP operating earnings reached $39.3 million, slightly above last year’s $38.1 million.

-

However, GAAP diluted EPS declined to $0.06, down from $0.14, primarily due to non-cash charges and acquisition-related adjustments.

Additionally, FirstService maintained a healthy balance sheet, ending the quarter with over $240 million in cash and restricted cash.

Strategic Initiatives and Market Performance

Operationally, both of FirstService’s divisions contributed to revenue growth:

FirstService Residential

-

Revenues increased 6% to $525.1 million, including 3% organic growth.

-

Adjusted EBITDA rose 17% to $41.6 million.

-

Margin improvements stemmed from operational efficiencies in property management service delivery.

FirstService Brands

-

Revenues climbed 10% to $725.7 million, bolstered by tuck-in acquisitions at Roofing Corp of America.

-

Adjusted EBITDA jumped 22% to $67.8 million.

-

While organic revenue declined 2%—mainly due to softness in some service lines—Century Fire Protection saw solid growth, helping to offset declines.

The company also focused on optimizing processes within its home services and restoration brands, resulting in improved cost structure and EBITDA margins.

Challenges and Outlook

Although FirstService reported impressive results, the outlook includes a few considerations:

-

Organic growth in FirstService Brands was slightly negative, signaling potential pressure in some markets.

-

GAAP earnings per share declined, reflecting acquisition-related costs and non-controlling interest impacts.

-

Rising interest expenses and continued acquisition integration efforts may weigh on short-term profitability.

That said, FirstService remains confident in its full-year targets. With a strong track record of value creation and a balanced mix of franchise and corporate operations, the company is well-positioned to continue scaling profitably.