In Q3 2024, RE/MAX Holdings, Inc. demonstrated operational discipline and resilient performance despite industry challenges. With ongoing economic uncertainty and a slowdown in the housing sector, RE/MAX focused on cost efficiency and global expansion to sustain its earnings. The company’s performance this quarter highlights its ability to adapt through strategic investments and disciplined financial management.

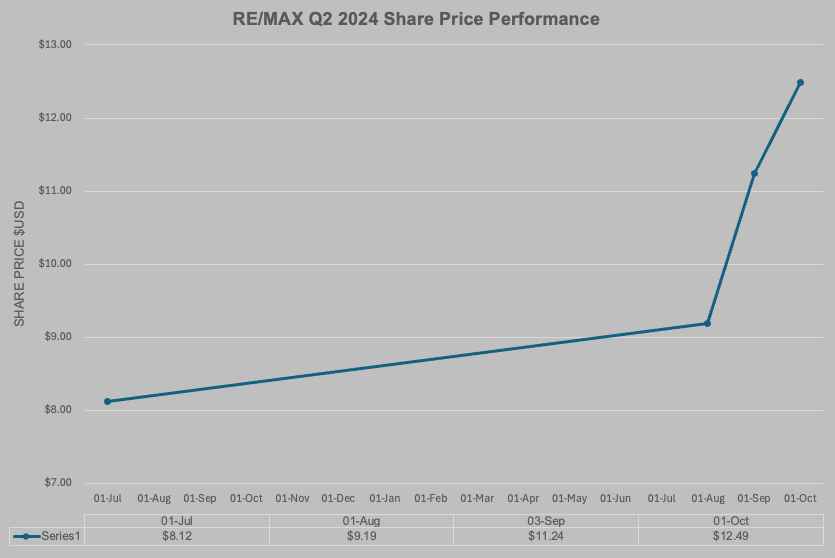

RE/MAX Share Price Performance Q3 2024

Key Financial Highlights

-

Revenue reached $78.5 million, down 3.4% year-over-year, primarily due to lower agent counts in the U.S. and decreased franchise sales.

-

Adjusted EBITDA rose 2.0% to $27.3 million, driven by effective cost reductions.

-

Adjusted EBITDA Margin improved to 34.8%, up from 32.9% in Q3 2023.

-

Adjusted Diluted EPS stood at $0.38, showing earnings stability in a shifting market.

-

Total agent count slightly increased to 145,483 globally (+0.1% YoY), with notable growth outside North America offsetting domestic declines.

-

Operating expenses dropped 16.6% to $35.9 million, reflecting savings in personnel, legal, and technology costs.

Strategic Initiatives and Market Performance

RE/MAX continued to optimize its dual-brand model, focusing on long-term scalability through the RE/MAX and Motto Mortgage franchises. While U.S. agent count fell 6.5%, international and Canadian networks hit record highs, highlighting the brand’s global appeal.

In the mortgage segment, Motto Mortgage offices declined slightly to 234 (-3.3% YoY), reflecting broader industry trends, but RE/MAX remained the only national mortgage brokerage franchise in the U.S.

Recurring revenue, comprising franchise fees and annual dues, remained strong at 66.4% of total revenue excluding marketing funds, providing a stable base even as variable revenues declined.

Despite a 3.0% decline in organic revenue, the company maintained robust free cash flow and capital flexibility. RE/MAX also preserved liquidity, ending the quarter with $83.8 million in cash and no draw on its revolving credit facility.

Challenges and Outlook

The broader housing market continued to soften in Q3, pressured by high mortgage rates, affordability issues, and limited inventory. Home sales and originations remain under pressure, affecting revenue across the real estate services sector.

Looking ahead, RE/MAX projects:

-

Q4 2024 revenue between $71.0–$76.0 million

-

Full-year 2024 revenue between $306.0–$311.0 million

-

Full-year adjusted EBITDA of $95.0–$98.0 million

Although domestic agent attrition persists, RE/MAX is investing in automation, support tools, and international franchise development to offset headwinds. Fee waivers and operational agility are expected to support affiliates affected by extreme weather events and market conditions.

Conclusion

RE/MAX Holdings’ Q3 2024 results underline its ability to maintain profitability through cost control and international growth despite market challenges. As the company continues to innovate and refine its franchise model, its global footprint and trusted brand position it for long-term resilience in a complex real estate environment.