Our Q2 Garage Organization report covers April to June 2024. North America’s economic conditions were characterized by persistent inflation impacting prices for consumer goods. Labor shortages in skilled trades continued, driving up wages and intensifying competition for talent. Supply chain disruptions, though less severe, still affected material availability. Rising digital advertising costs strained marketing budgets, challenging businesses to maintain their lead funnels. Although house prices are at all-time highs, new housing starts are relatively flat.

Higher interest rates have impacted consumer borrowing and debt servicing, resulting in less consumer spending.

We can anticipate a decrease in customer demand and a consistent number of companies competing for their spend, leading to a continued increase in advertising costs.

This is a critical time for garage organization companies to adjust revenue expectations and manage expenses as the headwinds are anticipated to continue through Q3.

Garage remodel companies will continue to face headwinds in consumer discretionary spending and consumer lending in the second half of the year.

Q2 Raw Material Costs

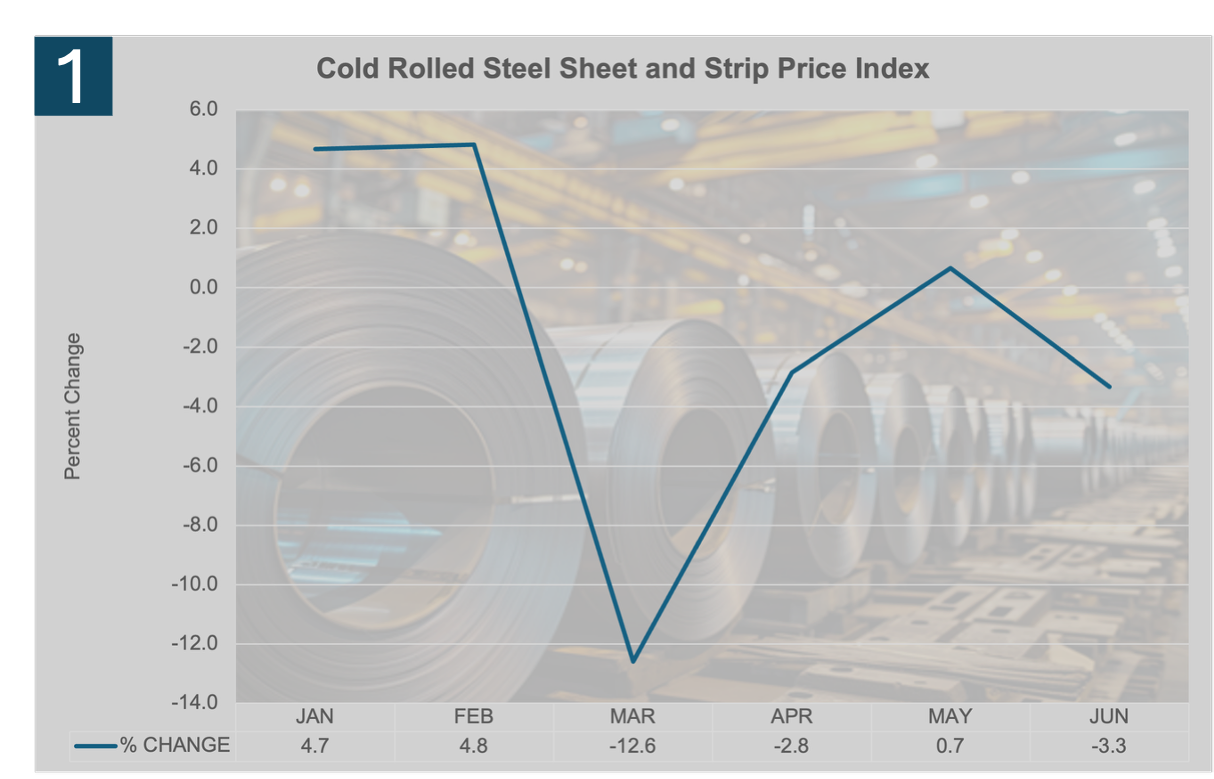

Cold Rolled Steel

Cold rolled steel is the primary choice for steel cabinetry and racking.

Prices for Q2 saw less volatility and are still down versus the benchmark pricing.

Steel demand has continued to remain strong in the fabricated metals segment.

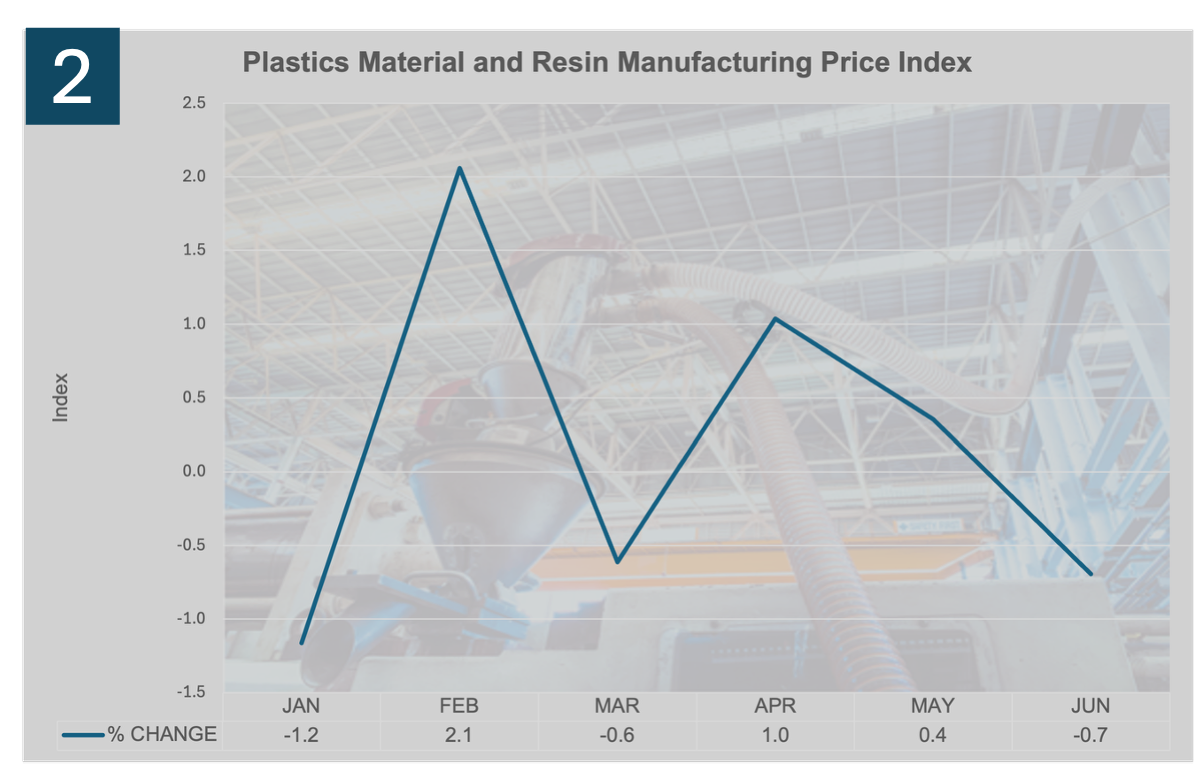

Plastics Material and Resin Manufacturing

Plastics and resin manufacturing has seen a steady increase in material costs since January. These materials are used in the production of slatwall and epoxy products.

Q2 prices have seen less volatility but remain elevated compared to the start of the year.

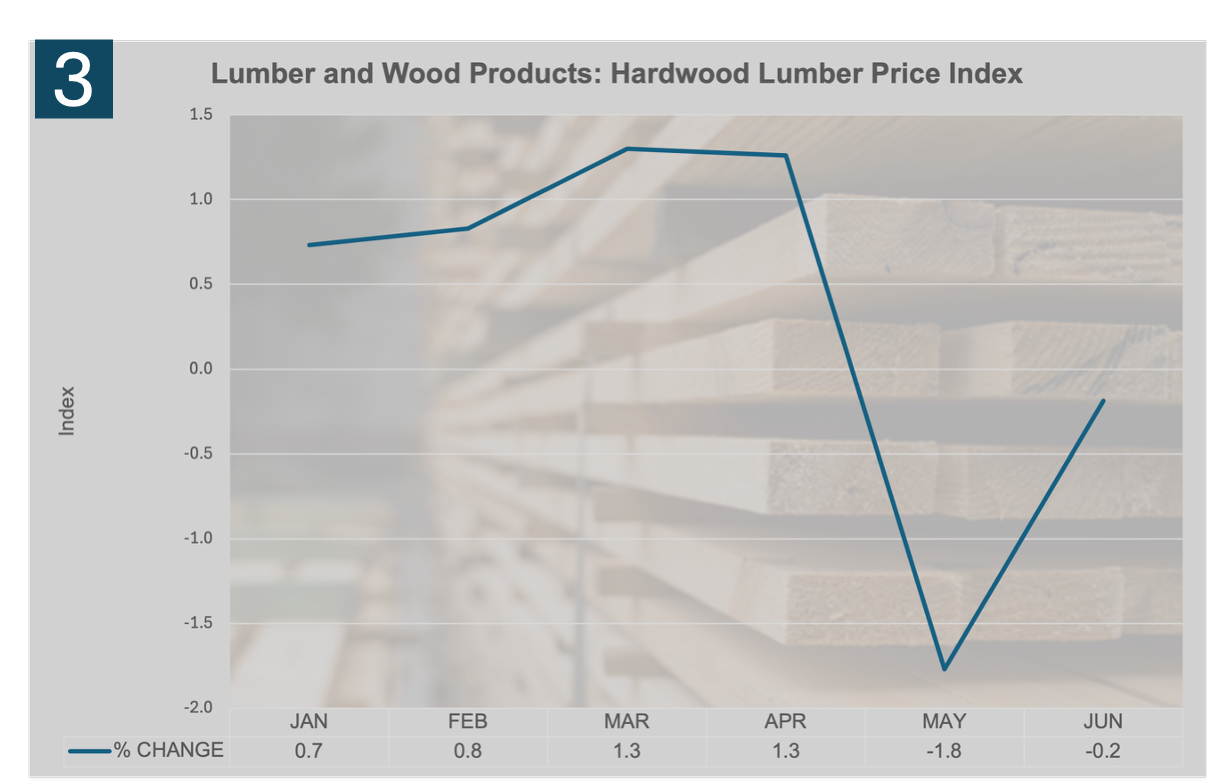

Hardwood Lumber

Hardwoods are used in the framing of homes and in the remodel market for additions and general construction.

Since April, prices have remained below Q1 levels with lumber prices anticipated to remain below indexing in Q3.

Q2 Industry Performance

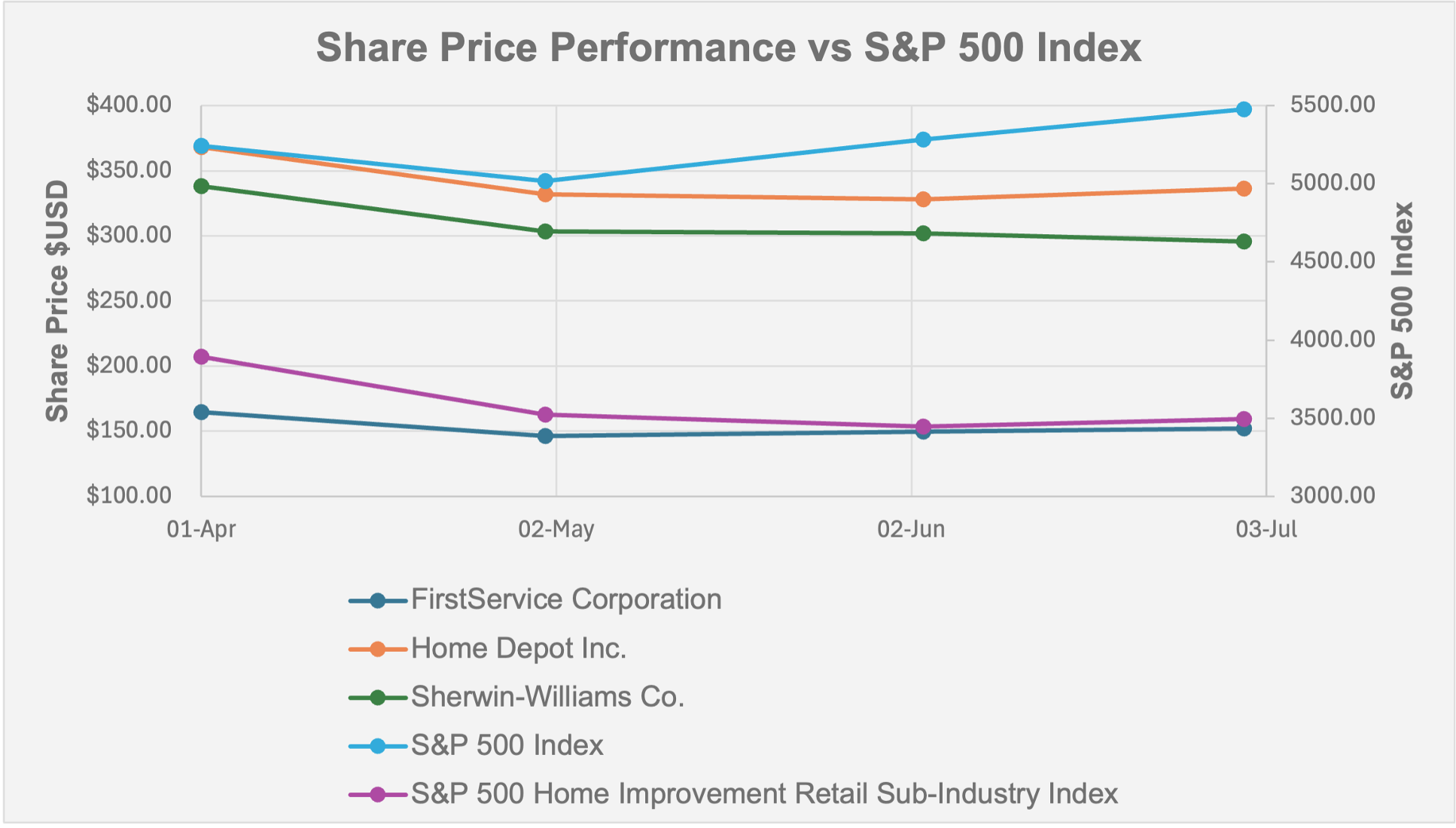

In Q2, the S&P 500 experienced a period of mixed performance, reflecting broader economic uncertainties and investor sentiment. The index saw fluctuations driven by various factors, including inflation concerns and central bank policy decisions. Despite some periods of volatility, the S&P 500 managed to maintain an upward trajectory, supported by strong performance in key sectors like technology and healthcare. The index saw growth of +8.4% during this quarter.

The S&P 500 Home Improvement Retail Index, which is a sub-industry that tracks the performance of Home Depot & Lowe’s, saw a -10.2% decrease over the quarter. This is due to the current economic conditions and overall consumer discretionary spending.

FirstService Corporation (includes brands such as California Closets, CertaPro Painters, and Floor Coverings International) drove $1.3B in revenue. FirstService Brands is made up of company-operated and franchisee operated locations. This division saw a decrease in year-over-year organic growth of 6%, meaning their residential business is down.

From a broader industry perspective, Sherwin-Williams saw its Consumer Brands segment down significantly in Q2 by -10.7% due to a weak economic environment. At the same time, their Paint Stores and Performance Coatings group saw modest low single-digit growth. The overall sentiment is the economic conditions are creating headwinds for the business.

A strong barometer of spending in the home can be attributed to Home Depot’s quarterly performance. Year over year, same-store sales are down 6%. Margin and operating income are also down slightly. The current economic environment continues to impact consumer spending on projects around their home.

Q2 Public Company Performance

FirstService (FSV)

Q2 Earnings Released July 25 – Consolidated revenues for the second quarter were $1.3 billion, a 16% increase relative to the same quarter in the prior year.

FirstService Brands (individually branded company-owned operations and franchise systems) revenues during the second quarter grew to $740.0 million, up 23% relative to the prior year period.

The revenue increase was driven by solid growth from Century Fire Protection and a significant contribution from the recent Roofing Corp of America acquisition.

On an organic basis, division revenues were down 6% versus the prior year’s second quarter.

The decrease in organic growth for the franchise division should be noted and will not be expanded on until the 2024 annual report filing.

Sherwin Williams (SHW)

Q2 Earnings Released July 23 – Consolidated sales increased 0.5% driven by higher sales volumes in Paint Stores and Performance Coatings Groups, partially offset by lower sales volume in the Consumer Brands Group.

Sherwin-Williams’ Consumer Brands Group experienced a -10.7% decline in Q2 2024 sales, primarily due to ongoing softness in DIY paint demand in North America.

The Paint Stores Group (PSG) grew in new residential, residential, commercial, and DIY segments. A decline in property management was due to delayed capex projects.

The Performance Coatings Group (PCG) saw decreases in the auto refinish, general industrial, and packaging segments.

Overall, the company saw margin improvements due to better cost absorption and moderating raw material costs.

Home Depot (HD)

Q2 Earnings Released August 13 – The Home Depot’s Q2 2024 results show a .6% increase in sales to $43.2 billion compared to Q2 2023.

12 new stores were added.

Net operating income and margins were down slightly versus Q2 2023.

Comparable same-store sales were down 4%.

This decline is attributed to homeowners spending less on major home improvement projects like kitchens and bathrooms.

The high interest rate environment, coupled with mortgages renewing at higher interest rates, paints a picture of added economic pressure on consumers for the balance of 2024.

The company remains optimistic about its product offerings and customer service as competitive advantages.

Competitive Landscape

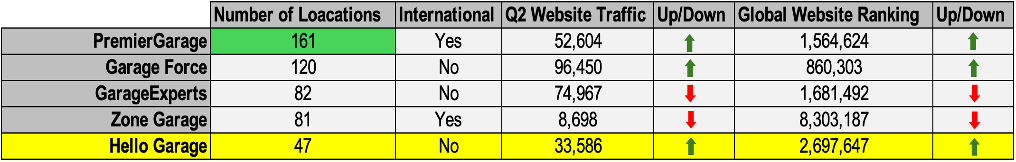

Top 5 Garage Organization Companies

This category includes flooring, wall organizers, cabinetry, and other garage related products.

The total number of garage remodel franchise organizations in North America remains in the low double digits. A low number of new units has been added to each of the systems in Q2.

*Based on Operating Locations as of June 30, 2024.

**US website ranking and a full competitor list available upon request.

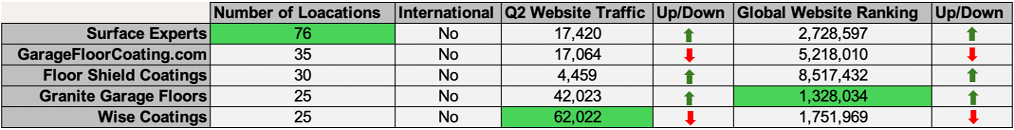

Top 5 Floor Coating Only Companies

This category includes floor coating only companies.

The total number of floor coating-only franchise organizations in North America remains in the low double digits. Some of these companies have begun the transition to garage remodeling by introducing new organization items.

*Based on Operating Locations as of June 30, 2024

**US website ranking and a full competitor list available upon request.

Closing Message

As we are now in the second half of 2024 and halfway through Q3, it’s important to recognize the challenges facing the broader U.S. economy. Manufacturers of steel, resins, lumber, and building products, as noted in my overview of Q2 Material Costs, are facing headwinds. Additionally, focusing on the home improvement industry reveals that publicly traded companies in this space are experiencing negative comparable growth versus the same period last year. This is a result of consumers who are dealing with high interest rates and competing priorities for their dollar. Keep an eye on the interest rate announcement on September 17, which, if reduced, could be a catalyst for consumer confidence and spending.

The competitive environment is shifting as companies focusing solely on floor coatings are starting to integrate garage organization products into their offerings. This will lead to increased competition for the same customer and put pressure on marketing budgets.

For franchise systems, recognizing the addition of new units is slowing and shifting focus to maximizing efficiency and profitability at the unit level will be critical for the balance of 2024.