Planet Fitness, a leading franchisor and operator of fitness centers, released its financial results for the second quarter of 2024 on August 6. The company demonstrated solid growth and strategic financial maneuvers, underscoring its resilience and potential for future expansion.

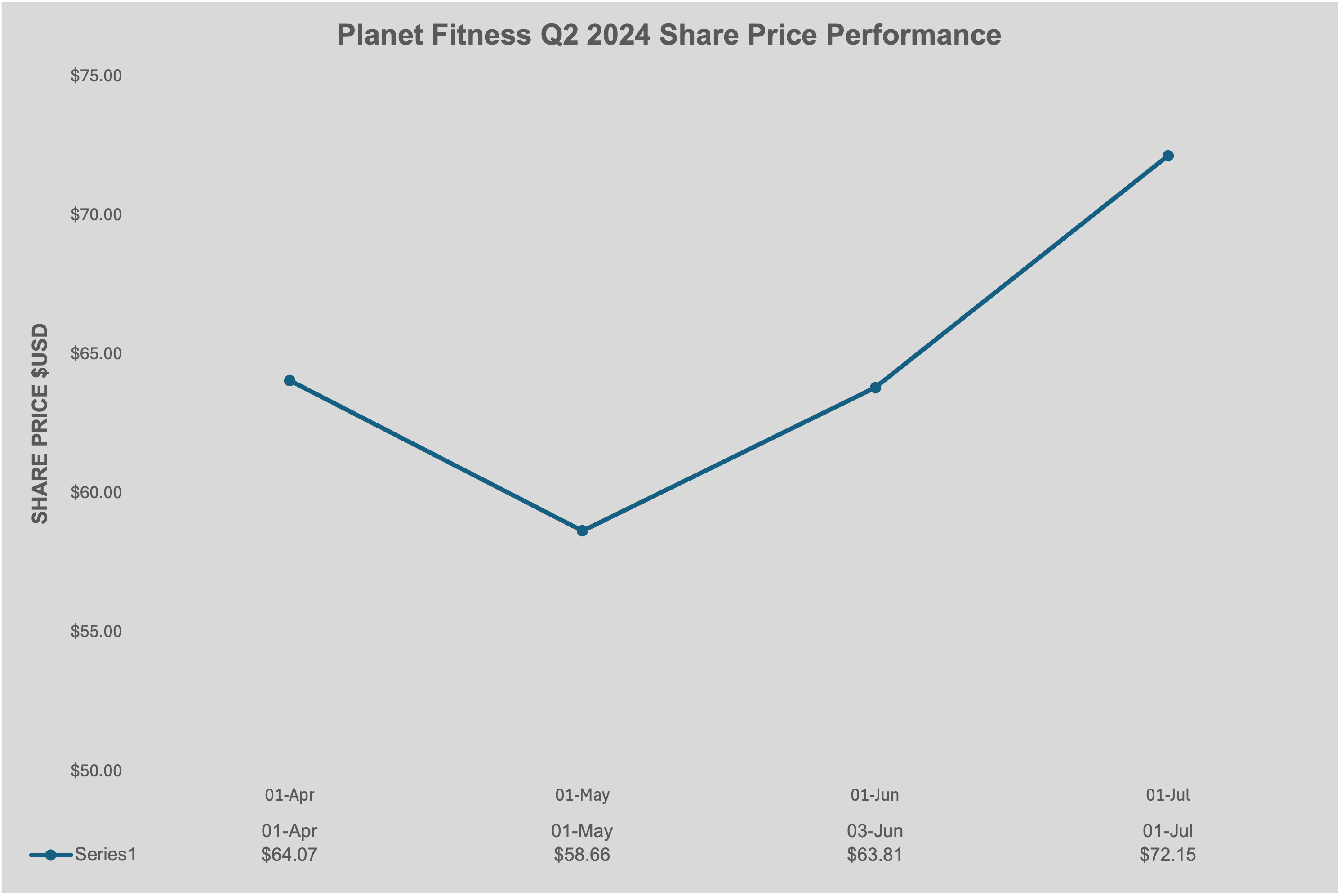

Share Price Performance

Planet Fitness Q2 2024 Share Price Performance

Key Financial Highlights

Revenue Growth: Planet Fitness reported a total revenue increase of 5.1% from the previous year, reaching $300.9 million. This growth was fueled by a 4.2% rise in system-wide same-store sales and an increase in system-wide sales to $1.2 billion from $1.1 billion in the prior year period.

Net Income: The net income attributable to Planet Fitness was $48.6 million, or $0.56 per diluted share, compared to $41.1 million, or $0.48 per diluted share, in the previous year. This marks a notable improvement in profitability.

Adjusted Metrics: Adjusted net income increased by $4.5 million to $62.2 million, or $0.71 per diluted share. Adjusted EBITDA also saw a rise, reaching $127.5 million, up from $118.9 million in the prior year period.

Operational Developments

Store Expansion: During the quarter, Planet Fitness opened 18 new stores, bringing the total to 2,617 locations worldwide. This expansion included 17 franchisee-owned and one corporate-owned store, highlighting the company’s commitment to growth.

Refinancing and Share Repurchase: The company successfully completed an $800 million refinancing transaction and executed a $280 million accelerated share repurchase program. These strategic financial moves are aimed at enhancing shareholder value and optimizing the company’s capital structure.

Segment Performance

Franchise Segment: Revenue from the franchise segment increased by 9.1% to $107.8 million. This growth was primarily driven by higher royalty revenue and increased contributions from new store openings.

Corporate-Owned Stores: Revenue from corporate-owned stores rose by 10.3% to $125.5 million, benefiting from same-store sales growth and additional revenue from newly opened and acquired stores.

Equipment Segment: The equipment segment experienced a decline in revenue by 8.4% to $67.7 million, mainly due to lower sales to new and existing franchisee-owned stores.

Strategic Outlook

Planet Fitness remains optimistic about its future growth prospects. The company reiterated its 2024 outlook, expecting:

New Equipment Placements: Approximately 120 to 130 in franchisee-owned locations.

New Store Openings: Around 140 to 150 new locations.

Revenue and Earnings Growth: Revenue is expected to increase by 4% to 6%, with adjusted EBITDA and net income projected to grow by 7% to 9% and 4% to 6%, respectively.

CEO’s Vision

Colleen Keating, the CEO of Planet Fitness, expressed confidence in the brand’s potential for long-term sustainable growth. She emphasized the importance of delivering an unparalleled member experience and evolving the brand’s messaging. Keating highlighted the asset-light, highly franchised business model as a key strength, allowing the company to capitalize on opportunities both domestically and internationally.

Planet Fitness’s Q2 2024 earnings report reflects a robust financial performance and strategic initiatives aimed at sustaining growth and enhancing shareholder value. With a strong focus on expansion and financial optimization, the company is well-positioned to navigate the competitive fitness industry landscape and achieve its ambitious growth targets.

Information Source: https://investor.planetfitness.com/investors/press-releases/press-release-details/2024/Planet-Fitness-Inc.-Announces-Second-Quarter-2024-Results/default.aspx