FirstService Corporation, a leader in outsourced property services across North America, reported its financial results for the first quarter of 2024, ending March 31. The company experienced significant growth in revenue, although some profitability metrics showed a decline compared to the same period last year.

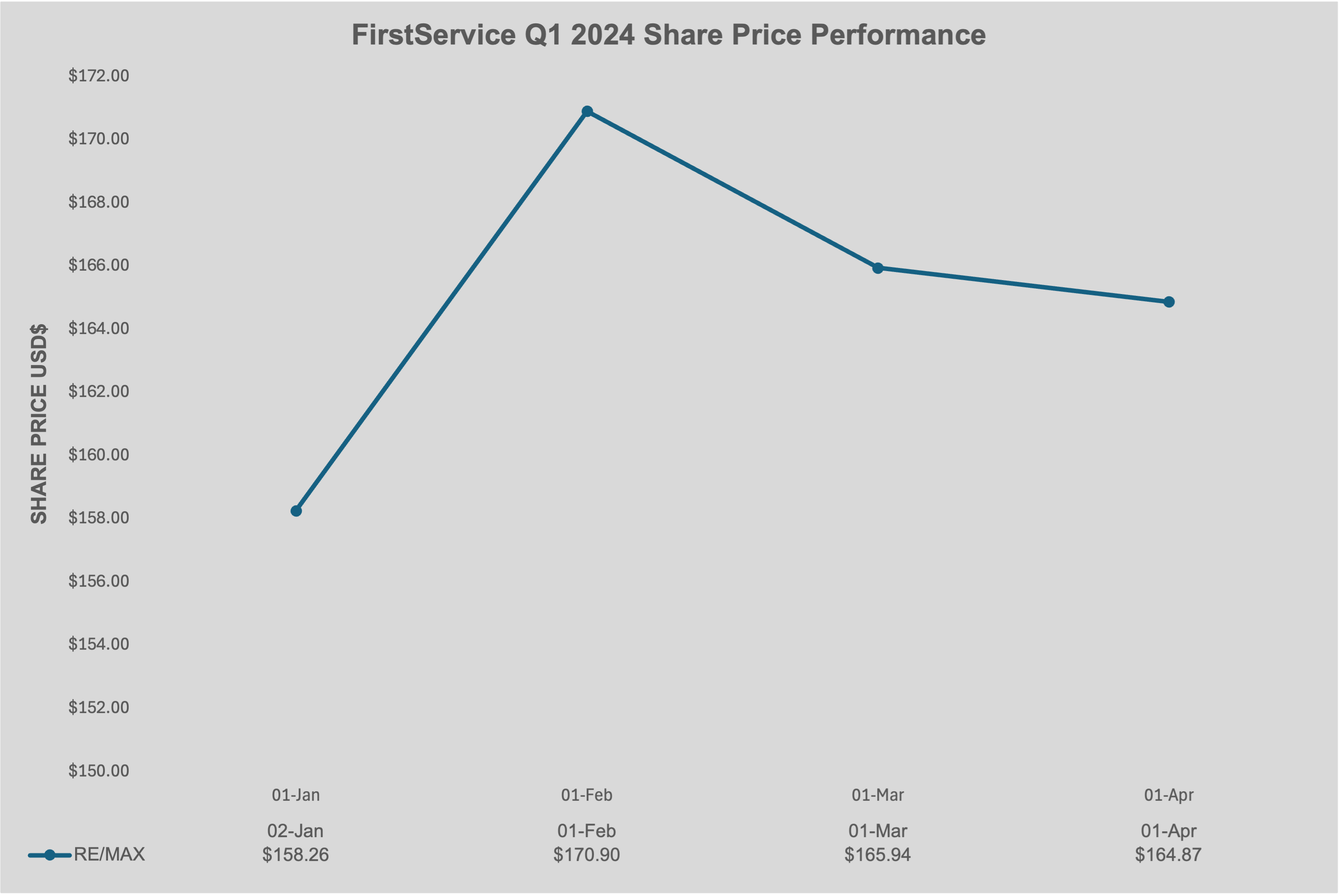

Share Price Performance

FirstService Q1 2024Share Performance

Financial Highlights

Revenue Growth: FirstService reported a 14% increase in consolidated revenues, reaching $1.16 billion compared to $1.02 billion in Q1 2023. This growth was driven by strong performance across both of its main divisions: FirstService Residential and FirstService Brands.

Adjusted EBITDA: The company’s Adjusted EBITDA, which is a measure of operating performance, rose slightly by 2% to $83.4 million from $82.1 million in the previous year.

Earnings Per Share (EPS): Adjusted EPS decreased to $0.67 from $0.85 in Q1 2023. GAAP diluted EPS also saw a decline, falling to $0.14 from $0.36 in the prior year.

Segment Performance

FirstService Residential

Revenue: The division reported revenues of $496.1 million, marking an 11% increase from the previous year. This growth included 8% organic growth, largely driven by new property management contracts.

Profitability: Adjusted EBITDA for this segment increased to $35.6 million from $32.0 million, while operating earnings rose to $26.7 million from $22.7 million in Q1 2023.

FirstService Brands

Revenue: This segment achieved revenues of $661.9 million, a 16% increase over the previous year. The growth was fueled by double-digit organic growth at Century Fire Protection and contributions from the recent acquisition of Roofing Corp of America.

Profitability: Despite revenue growth, operating earnings in this segment declined to $26.8 million from $30.2 million due to lower profitability in restoration brands and increased marketing expenses.

Operational Insights

Scott Patterson, the CEO of FirstService, expressed satisfaction with the company’s performance, noting that the results were in line with expectations. He emphasized confidence in achieving the company’s performance targets for the year, supported by strong indicators across their business operations.

Challenges and Outlook

While FirstService experienced robust revenue growth, the decline in EPS and operating earnings indicates challenges in maintaining profitability amidst rising costs and operational adjustments. The company faced increased corporate costs, primarily due to foreign exchange impacts, which rose to $15.4 million from $11.9 million in Q1 2023.

Looking ahead, FirstService remains focused on leveraging its strong market position in property services to drive future growth and shareholder value. However, the company acknowledges potential risks including economic conditions and regulatory changes that could impact its operations.

In summary, FirstService’s Q1 2024 results reflect strong top-line growth driven by strategic expansions and acquisitions, though profitability metrics highlight areas for operational improvement. The company appears well-positioned to continue its growth trajectory while addressing the challenges of cost management and market dynamics.

Information Source: https://www.firstservice.com/investors/newsroom.html