Snap-on Incorporated, a prominent player in the global tools and equipment industry, released its financial results for the second quarter of 2024 on July 18. Despite facing some challenges, the company has shown resilience and strategic growth in several areas. Here’s a breakdown of Snap-on’s performance in Q2 2024.

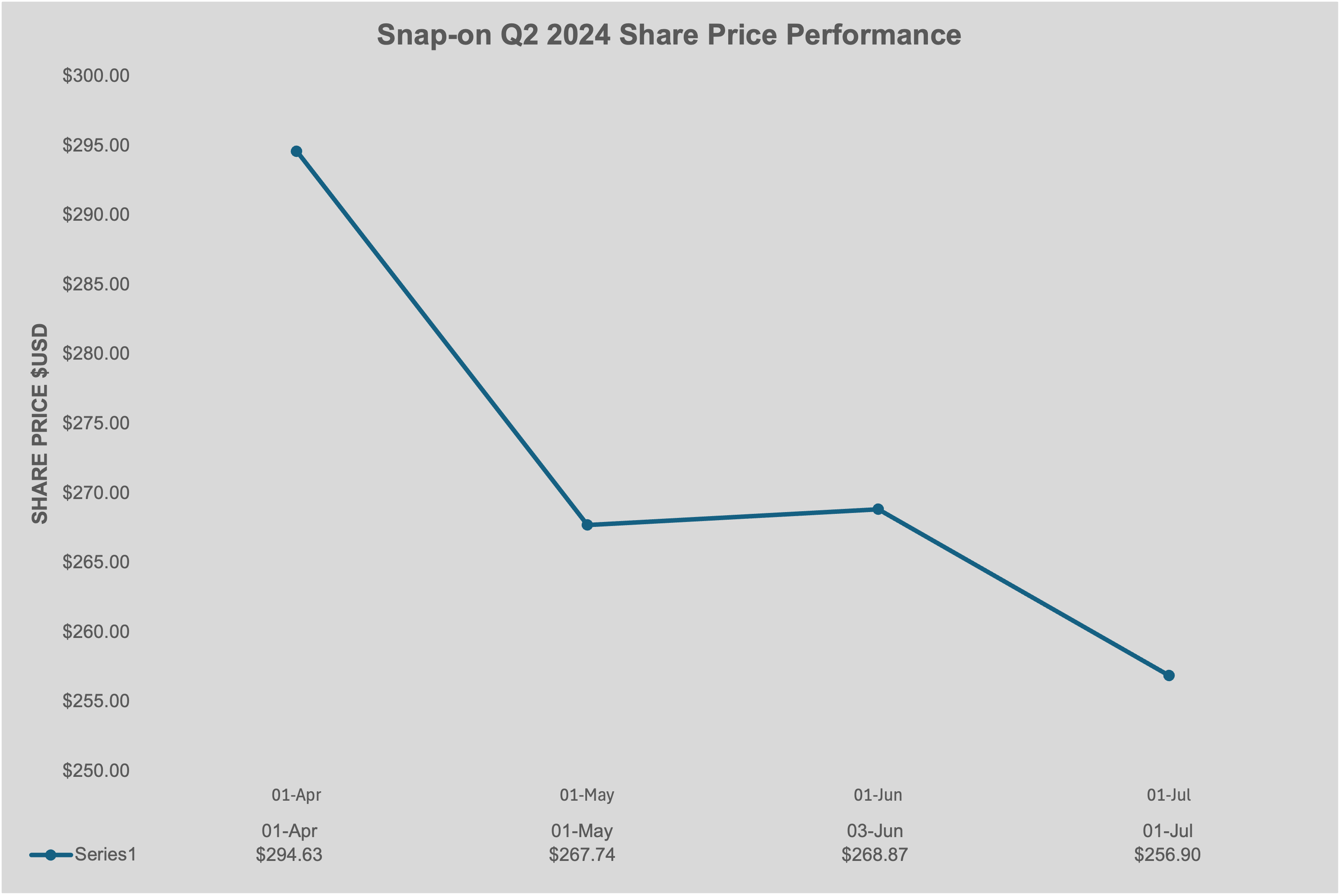

Share Price Performance

Snap-on Q2 2024 Share Price Performance

Financial Highlights

Net Sales and Earnings: Snap-on reported net sales of $1,179.4 million for the second quarter of 2024, a slight decrease of 1.0% compared to $1,191.3 million in Q2 2023. This decline was primarily due to a 1.1% drop in organic sales and unfavorable foreign currency translations, partially offset by acquisition-related sales.

Operating Earnings: The company’s operating earnings before financial services were $280.3 million, up from $277.0 million in the previous year. This represents an operating margin of 23.8%, a slight improvement from 23.3% in Q2 2023.

Net Earnings: Net earnings for the quarter were $271.2 million, or $5.07 per diluted share, compared to $264.0 million, or $4.89 per diluted share, a year ago. This increase includes a $0.16 per share benefit from a legal payment.

Financial Services: Snap-on’s financial services revenue increased to $100.5 million from $93.4 million in the same quarter last year, with operating earnings in this segment rising to $70.2 million from $66.9 million.

Segment Performance

Snap-on operates through several segments, each contributing differently to the overall performance:

Commercial & Industrial Group: This segment saw sales rise to $372.0 million, up from $364.2 million in 2023, driven by increased activity in critical industries. However, this was partially offset by declines in power tool and European-based hand tool operations.

Snap-on Tools Group: Sales in this segment dropped to $482.0 million from $523.1 million last year, largely due to reduced activity in U.S. operations. However, international operations showed stronger performance.

Repair Systems & Information Group: Sales slightly increased to $454.8 million from $452.0 million, supported by higher activity with OEM dealerships, though offset by lower sales of diagnostic products to independent repair shops.

Strategic Insights and Future Outlook

Snap-on’s CEO, Nick Pinchuk, expressed optimism about the company’s future, highlighting the resilience and growth opportunities in the current market environment. The company is focused on leveraging its Snap-on Value Creation Processes to drive advancements and improvements. This strategic focus aims to maintain and increase momentum in the automotive repair sector and expand into adjacent markets and geographies.

Looking ahead, Snap-on plans to invest between $100 million and $110 million in capital expenditures for 2024, with $45 million already spent in the first half of the year. The company anticipates its full-year effective income tax rate to be between 22% and 23%.

Snap-on’s Q2 2024 earnings report reflects a company navigating challenges with strategic foresight and operational efficiency. While there are areas of decline, particularly in the Snap-on Tools Group, the overall financial health remains robust, with improvements in operating margins and net earnings. As Snap-on continues to innovate and expand its market reach, it positions itself for sustained growth in the coming quarters.

Information source: https://www.snapon.com/EN/Investors/Financial-Information/Quarterly-Earnings