April 18, 2024

Despite facing some headwinds, the company demonstrated its ability to maintain profitability and manage costs effectively.

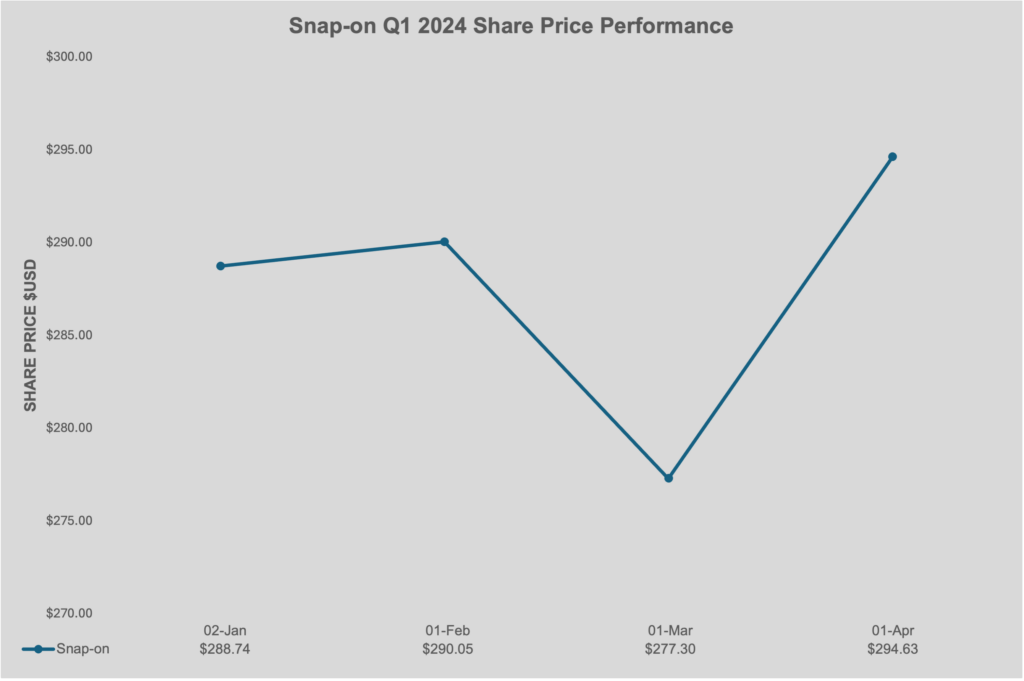

Share Price Performance

Financial Highlights

Snap-on reported diluted earnings per share (EPS) of $4.91 for Q1 2024, which included a $0.16 per share benefit from a legal payment. This compares favorably to an EPS of $4.60 in the same quarter of 2023, showcasing Snap-on’s continued profitability. However, net sales for the quarter were $1,182.3 million, reflecting a slight decrease of 0.1% from the previous year. This decline was primarily attributed to a $9.9 million decrease in organic sales, partially offset by acquisition-related sales and favorable foreign currency translation.

Operating earnings before financial services increased to $270.9 million from $259.8 million in Q1 2023. This improvement was reflected in the operating margin, which rose to 22.9% from 22.0% a year ago. Revenue from financial services also grew to $99.6 million, with operating earnings reaching $68.3 million, up from $66.3 million in the previous year. This segment continues to be a significant contributor to Snap-on’s overall profitability.

Segment Performance

Commercial & Industrial Group: This segment experienced a slight decline in sales to $359.9 million, primarily due to reduced demand for power tools and in the Asia-Pacific region. Despite this, operating earnings remained stable at $55.4 million, with a marginal increase in the operating margin to 15.4%.

Snap-on Tools Group: Sales in this segment fell to $500.1 million, reflecting a 7.0% decline in organic sales. The main factors contributing to this decline were decreased activity in U.S. operations, partially offset by higher sales in international markets. Additionally, higher tool prices and increased borrowing costs have dampened demand among U.S. vehicle service and repair technicians, leading many to defer purchasing new tools. As a result, operating earnings decreased to $117.3 million, with the operating margin dropping to 23.5% from 24.5% a year ago.

Repair Systems & Information Group: This segment saw a positive performance with sales rising to $463.8 million, driven by increased activity with OEM dealerships and higher sales of undercar equipment. Operating earnings improved to $112.9 million, with the operating margin increasing to 24.3%.

Strategic Outlook and Future Prospects

Snap-on remains optimistic about its future prospects, emphasizing its resilience in the face of economic uncertainties. The company plans to continue leveraging its strengths in the automotive repair sector while expanding into adjacent markets and geographies. Snap-on anticipates capital expenditures for 2024 to be between $100 million and $110 million, focusing on growth and innovation.

CEO Nick Pinchuk highlighted the company’s commitment to aligning with technician preferences and maintaining momentum in critical industries. Snap-on aims to reinforce its brand through new product introductions and enhance its operational efficiency via the Snap-on Value Creation Processes.

Conclusion

Overall, Snap-on’s Q1 2024 results demonstrate its ability to navigate a challenging economic landscape while maintaining a strong financial position. The company’s strategic initiatives and focus on core markets are expected to support continued growth and profitability in the coming quarters. Despite the challenges faced in the Snap-on Tools Group, the company’s diversified portfolio and robust financial services segment provide a solid foundation for future success.

Snap-on’s commitment to innovation and operational excellence positions it well to capitalize on emerging opportunities and drive long-term shareholder value. As the company continues to adapt to changing market dynamics, its strategic focus on customer needs and operational efficiency will be key drivers of sustained growth and profitability.

Information souced from:https://www.snapon.com/EN/Investors/Financial-Information/Quarterly-Earnings