In the first quarter of 2024, RE/MAX Holdings, Inc. reported a mixed set of financial results, reflecting challenges in the real estate market but also highlighting areas of operational strength and strategic focus. Here’s a summary of their performance:

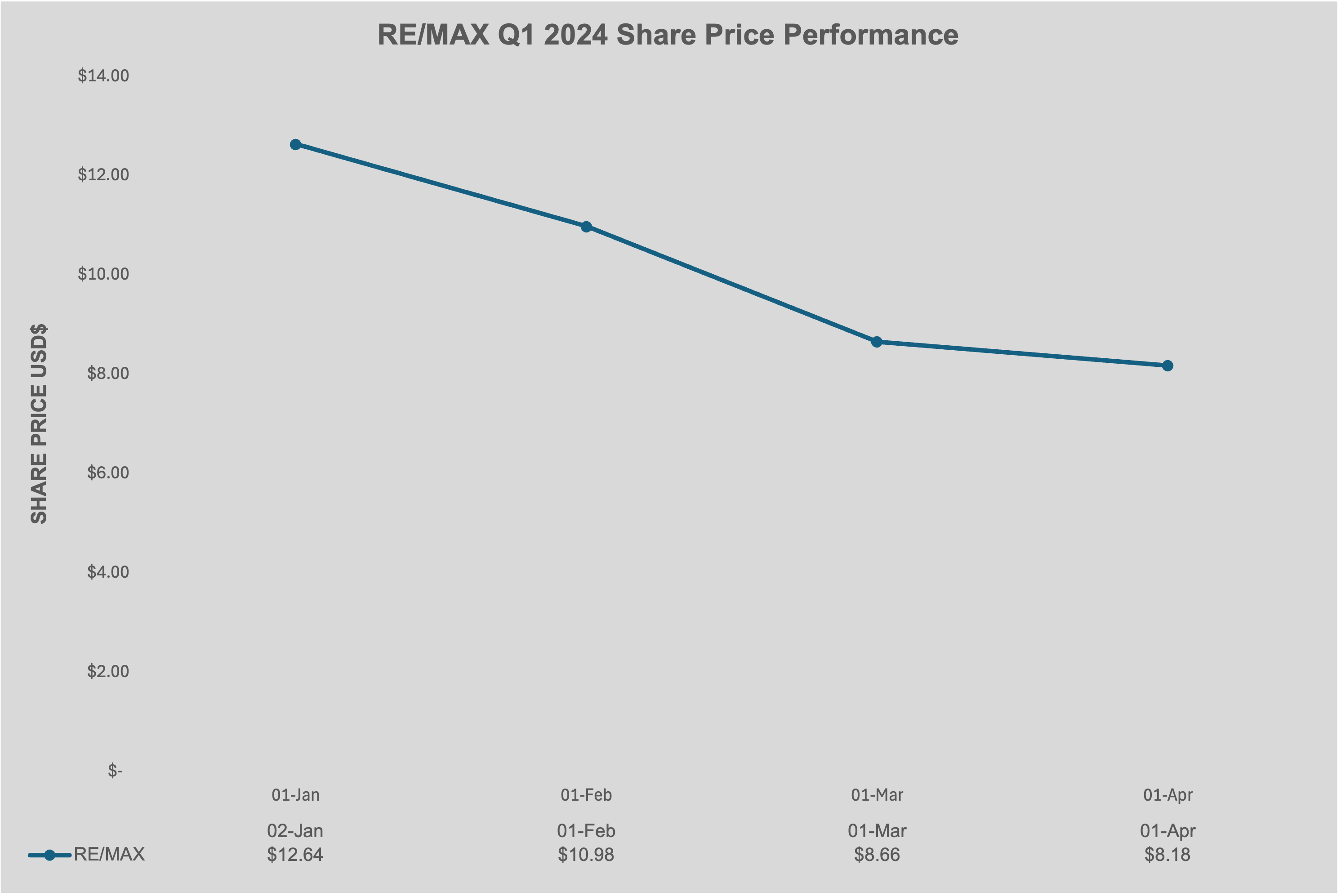

Share Price Performance

RE/MAX Q1 2024 Share Performance

Financial Highlights

Revenue: RE/MAX’s total revenue for Q1 2024 was $78.3 million, marking an 8.3% decrease compared to $85.4 million in Q1 2023. Revenue excluding Marketing Funds fell by 9.3% to $58.1 million, primarily due to a 9.3% decline in organic growth.

Net Loss: The company reported a net loss of $3.4 million, or $0.18 per diluted share, compared to a net loss of $0.7 million, or $0.04 per share, in the same period last year.

Adjusted EBITDA: Adjusted EBITDA decreased by 4.7% to $19.0 million, with an adjusted EBITDA margin of 24.3%, up from 23.3% in Q1 2023. Adjusted earnings per diluted share were $0.20, down from $0.26 in the previous year.

Operational Performance

Agent Count: The total agent count decreased by 236 agents, or 0.2%, to 143,287. In the U.S. and Canada, the combined agent count fell by 4.3% to 78,955.

Motto Mortgage Franchises: The number of open Motto Mortgage franchises increased by 4.7% to 243 offices, indicating growth in this segment.

Strategic and Market Insights

Cost Management: CEO Erik Carlson emphasized effective cost management, which contributed to maintaining solid margin performance despite market uncertainties. The company is focused on efficiency and delivering top-tier customer experiences.

Agent Productivity: RE/MAX agents were recognized as the most productive in the U.S., outperforming competitors by a 2-to-1 margin for the 16th consecutive year, a key differentiator for the brand.

Market Conditions: The real estate market faced challenges, impacting revenue from RE/MAX’s annual agent convention and U.S. agent count, though these were partially offset by higher revenue in the Mortgage segment.

Outlook

For the second quarter of 2024, RE/MAX anticipates:

Agent Count: A change ranging from a decrease of 1.5% to stable growth over Q2 2023.

Revenue: Expected to be between $75.0 million and $80.0 million, including Marketing Funds revenue.

Adjusted EBITDA: Projected to range from $24.0 million to $27.0 million[1].

For the full year 2024, expectations include:

Agent Count: A change between a decrease of 0.5% to an increase of 1.5% compared to 2023.

Revenue: Anticipated to be between $300.0 million and $320.0 million.

Adjusted EBITDA: Forecasted to be between $90.0 million and $100.0 million[1].

In summary, while RE/MAX faced revenue challenges in Q1 2024, the company demonstrated resilience through strategic cost management and maintained strong agent productivity. The outlook suggests cautious optimism, with potential for growth in the coming quarters.

Information Sourc: https://investors.remaxholdings.com/financials/quarterly-results/default.aspx