McDonald’s released its earnings report for the second quarter of 2024 on July 29, revealing a mixed bag of financial results. Despite some challenges, the company continues to focus on strategic growth and value offerings to navigate the current economic landscape.

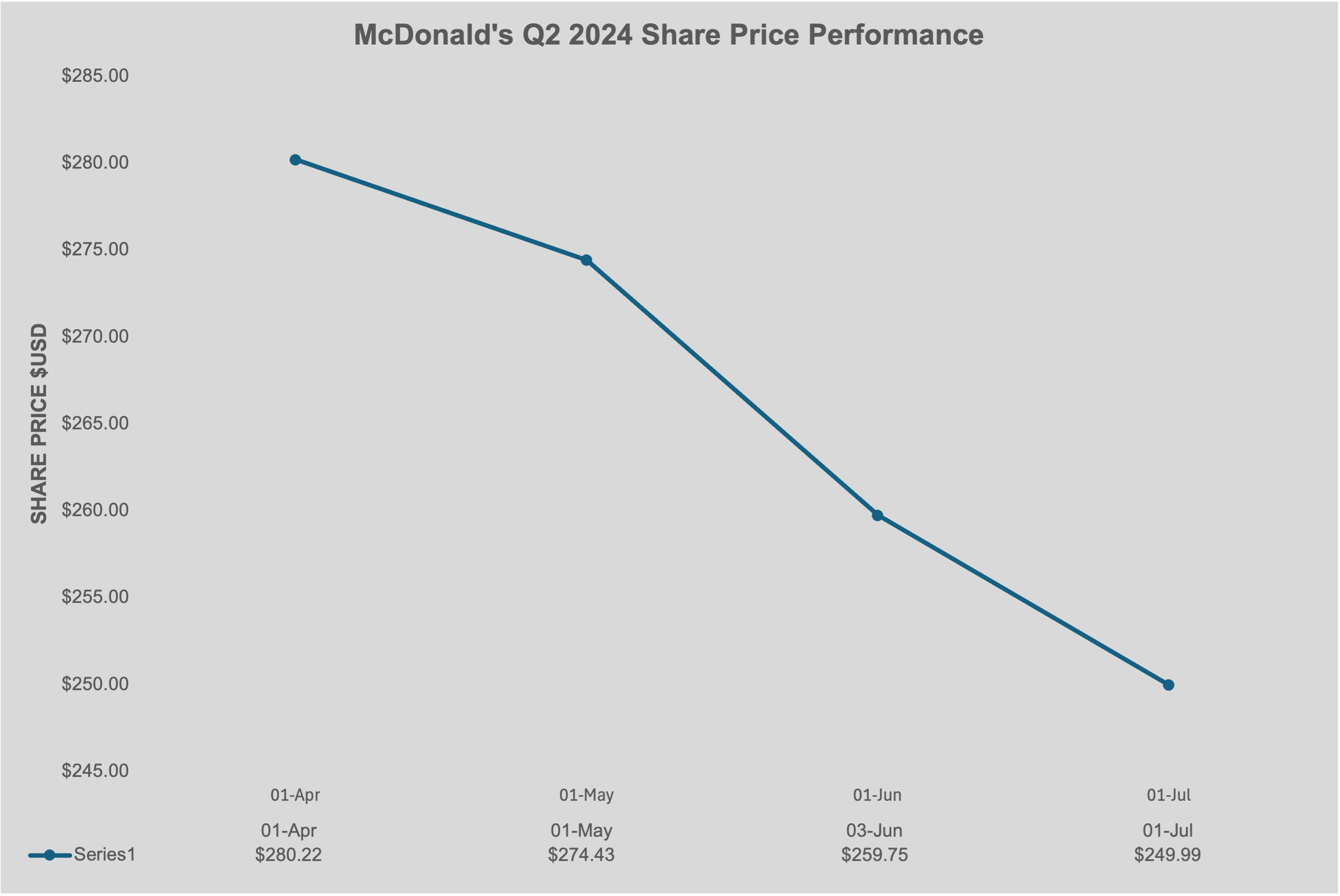

Share Price Performance

McDonald’s Q2 2024 Share Price Performance

Financial Overview

Revenues: McDonald’s reported consolidated revenues of approximately $6.5 billion for the quarter, which is flat compared to the previous year but shows a 1% increase when adjusted for constant currencies.

Operating Income: The operating income dropped by 6% to $2.92 billion, partly due to $97 million in non-cash impairment charges and $57 million in restructuring charges related to the company’s “Accelerating the Organization” initiative.

Net Income and Earnings Per Share: The net income for the quarter was $2.022 billion, a 12% decline from the previous year. Diluted earnings per share decreased by 11% to $2.80. However, excluding the charges mentioned above, the earnings per share would have been $2.97, marking a 6% decrease.

Sales Performance

Global Comparable Sales: There was a 1% decline in global comparable sales, with negative results across all segments:

- U.S. sales decreased by 0.7%.

- Internationally operated markets saw a 1.1% decline, primarily impacted by weak performance in France.

- International Developmental Licensed Markets experienced a 1.3% drop, with challenges in China and the Middle East offsetting positive sales in Latin America and Japan.

Strategic Initiatives and Challenges

McDonald’s is actively pursuing its “Accelerating the Arches” strategy, which focuses on delivering reliable value and expanding growth drivers like chicken products and loyalty programs. Despite a challenging economic environment, the company is committed to enhancing customer experience through digital and delivery services.

Menu and Pricing: The company has implemented strategic menu price increases, which have helped offset some of the declines in guest counts in the U.S. market.

Digital and Delivery Growth: Continued investment in digital platforms and delivery services has positively contributed to the company’s performance, indicating a shift in consumer preferences towards convenience.

Market-Specific Insights

U.S. Market: The decline in comparable sales was driven by fewer guest visits, although this was partially balanced by higher average checks due to price adjustments.

International Markets: The performance varied significantly, with some regions like Latin America and Japan showing resilience, while others, such as China and the Middle East, faced ongoing challenges due to geopolitical tensions.

Conclusion and Outlook

Despite facing a tough quarter, McDonald’s remains focused on its strategic goals to drive growth and maintain its position as a leading global foodservice retailer. The company’s emphasis on digital innovation, menu optimization, and loyalty programs is expected to play a crucial role in navigating future challenges.

Looking ahead, McDonald’s will need to continue adapting to changing consumer behaviors and economic conditions to sustain its growth trajectory. The company’s ability to leverage its global presence and brand strength will be key to overcoming the hurdles it faces in various markets.

Information Source: https://corporate.mcdonalds.com/corpmcd/our-stories/article/Q2-2024-results.html