Hilton Worldwide Holdings Inc. reported strong financial results for the first quarter of 2024, showcasing robust growth and strategic expansion efforts. Here’s a simplified summary of their performance and key activities during this period.

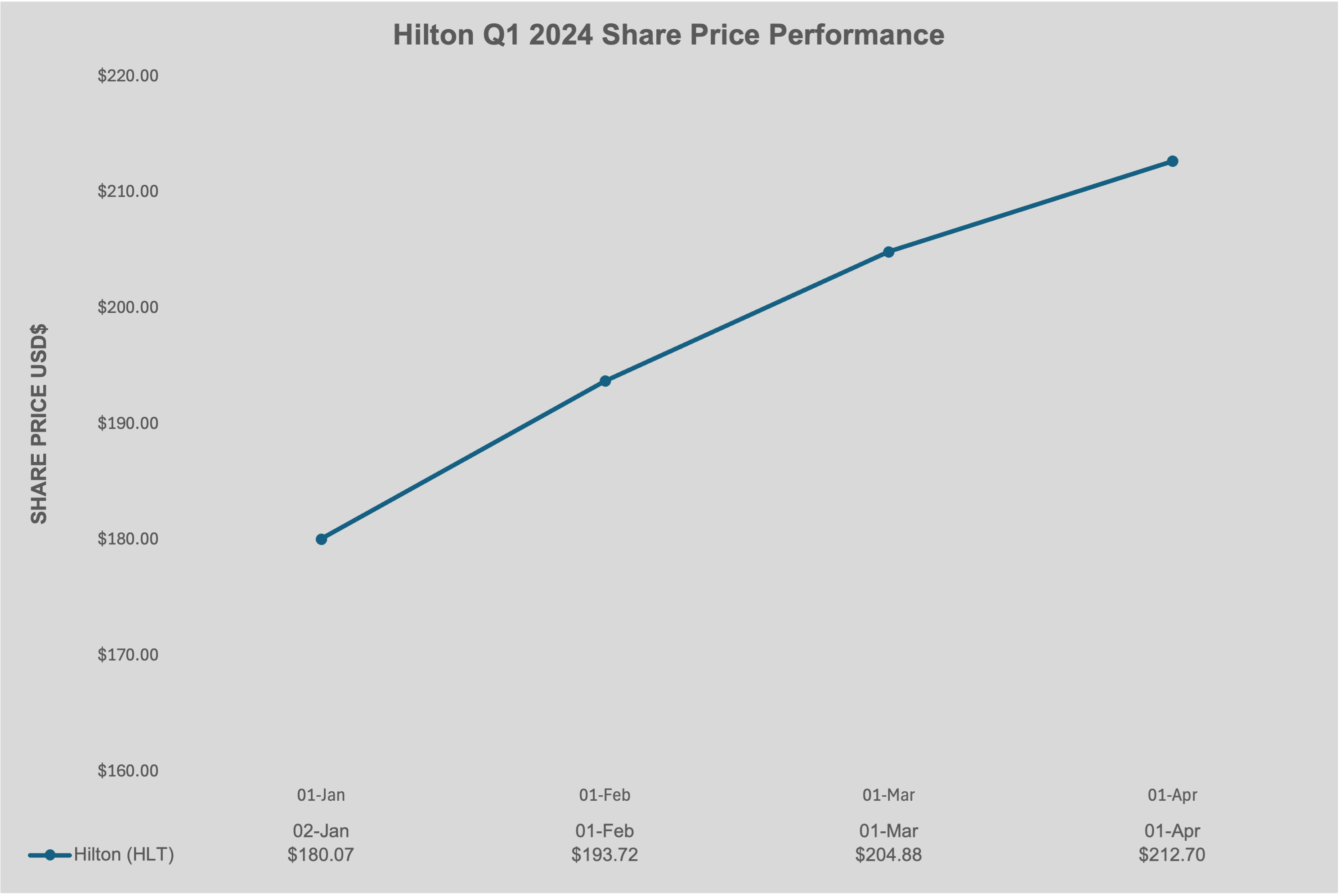

Share Price Performance

Hilton Q1 2024 Share Price Performance

Financial Performance

Earnings Per Share (EPS): Hilton reported a diluted EPS of $1.04 for Q1 2024, which increased to $1.53 when adjusted for special items. This marks an improvement from the previous year, where the adjusted EPS was $1.24.

Net Income and EBITDA: The company achieved a net income of $268 million and an adjusted EBITDA of $750 million. These figures represent a noticeable increase from the same quarter in 2023, where net income was $209 million and adjusted EBITDA was $641 million.

Revenue Per Available Room (RevPAR): System-wide comparable RevPAR increased by 2.0% compared to Q1 2023. This growth was driven by higher occupancy rates and average daily rates (ADR), despite some challenges such as renovations and weather-related disruptions.

Strategic Developments

Expansion and Development: Hilton approved the development of 29,800 new rooms, expanding its pipeline to a record 472,300 rooms globally. During Q1 2024, Hilton added 16,800 rooms to its system, resulting in a net addition of 14,200 rooms, which contributed to a net unit growth of 5.6% from the previous year[1].

Acquisitions and Partnerships: The company announced plans to acquire the Graduate Hotels brand, which will add approximately 35 hotels to its portfolio in the second quarter. Furthermore, Hilton acquired a controlling interest in the Sydell Group, owner of the NoMad brand, marking its entry into the luxury lifestyle segment[1].

Notable Openings: The first quarter saw several significant hotel openings, including the Conrad Orlando in Florida, the debut of LXR Hotels & Resorts in Hawaii, and the introduction of the Waldorf Astoria and Canopy by Hilton brands in the Seychelles. Hilton also launched the Curio Collection by Hilton in Kenya and the Motto by Hilton brand in Peru.

Financial Strategy and Outlook

Capital Returns: Hilton returned $701 million to shareholders in Q1 2024 through share repurchases and dividends. The company repurchased 3.4 million shares of its common stock during the quarter.

Debt Management: Hilton issued $1 billion in senior notes to manage its debt, with no significant maturities due until May 2025. The company maintains a strong liquidity position with $1.42 billion in cash and equivalents[1].

Future Projections: For the full year 2024, Hilton projects a system-wide RevPAR increase of 2.0% to 4.0%, with net income expected to range between $1.586 billion and $1.621 billion. Adjusted EBITDA for the year is projected to be between $3.375 billion and $3.425 billion.

Overall, Hilton’s Q1 2024 results reflect a solid financial performance and strategic growth initiatives, positioning the company for continued success in the hospitality industry.

Information Source: https://ir.hilton.com/financial-reporting/quarterly-results/2024